In February 2019, Massachusetts Financial Services Company (MFS) issued its 2019 U.S. Proxy Voting Policies and Procedures. The majority of the material policy updates related to the election of directors and focused on board diversity, overboarding and board size. The changes are summarized below.

In addition, we have provided insight into other relevant voting information from MFS to consider going into 2019 proxy season.

Election of directors

Historically, MFS has generally supported director nominees in elections, as showcased in the data below from Georgeson's 2018 Annual Corporate Governance Review.[1] The table details MFS's frequency in voting for director elections for companies in the Russell 3000 over the last four years. There was an increase in votes against directors in 2018, most likely due to last year's policy changes that introduced gender diversity and strengthened their stance on overboarding.

Updates to Policy on Board Diversity

This year, MFS has further updated its policy on board diversity, which was new last year. They now expect U.S. companies to have at least 15% female representation, compared to 10% when they first instituted this board diversity policy. If there is less than 15% representation, the investment firm will generally vote against the chair of the nominating and governance committee. In determining its final voting decision, MFS may consider any progress that a company is making to increase its board diversity. In this context, a company with less than 15% female representation on its board may, therefore, benefit from enhancing disclosure and/or engaging with shareholders on the steps they are taking to improve gender diversity. Please note, in 2018, MFS joined 'The Diversity Project' sponsored by investment body NICSA. This initiative promotes diversity in the asset management industry.

In our view, greater institutional focus from investors like MFS should, over time, accelerate the rate of growth in female board representation.

Updates to its Overboarding Policy

MFS added additional exception language under its overboarding policy. They may now consider if the company has timely disclosed an overboarded director's plans to step down from public company boards to be aligned with the policy. Under its 2018 updated policy regarding directors who sit on an excessive number of boards, MFS reduced the total number of boards from five to four for a non-CEO director, and from three to two for a director who also serves as CEO of a public company. In its 2018 policy, MFS stated they would consider an exception to its overboarding policy if the director exceeds the permitted number of seats due to either 1.) the director's board service on an affiliated company or 2.) served on more than one investment company board within the same investment complex. New this year, MFS added additional language around how the firm would further consider exceptions if the company has disclosed the overboarded director's plan to step down from the number of public company boards exceeding four or two, where applicable, within a reasonable timeframe.

Given this change, companies should review the total number of boards on which its directors serve, especially in cases involving CEOs of public companies. As with changes to board diversity, it would be recommended to enhance disclosure and/or engage with shareholders on any steps the company is taking regarding overboarded directors.

Board Size

New this year, MFS has implemented a policy in which they will vote against the chair of the nominating and governance committee in instances where the size of the board is greater than 16 members. MFS stated it believes the "size of the board can have an effect on the board's ability to function efficiently." According to the 2018 Spencer Stuart Board Index, 75% of companies in the S&P 500 have a board comprised of nine to 12 directors, with the average board size for these companies at 10.8 directors.[2] Companies with over 16 directors will need to take MFS's new policy into account when considering future board size to meet the investor's board size expectation.

MFS Voting History from Georgeson's 2018 Annual Corporate Governance Review

Say-on-pay Proposal Voting History – S&P 500

MFS's support for say-on-pay proposals has increased slightly over the past four years, from 91.2% to 92.2%. The table below details MFS's frequency in voting for say-on-pay proposals for companies in the S&P 500 over the last four years.[1]

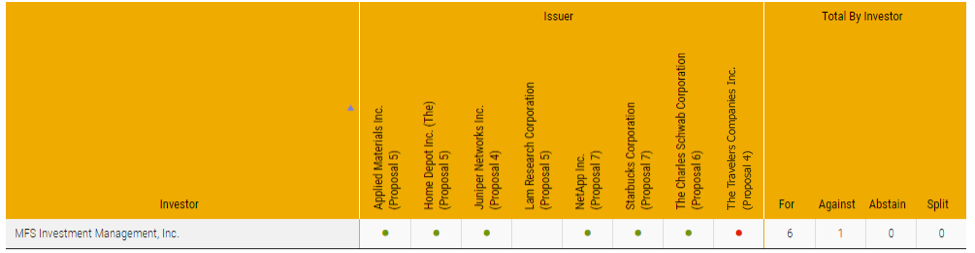

2018 Employment Diversity Shareholder Proposal Voting History – S&P 1500

As noted in in our 2017 and 2018 Annual Corporate Governance Review reports, during the 2017 and 2018 proxy seasons, several prominent institutional investors appear to have changed their voting policies on environmental and social matters, and were more supportive of certain shareholder-sponsored proposals on these issues.

The table below details MFS's voting history on a recent shareholder proposal related to employment diversity reporting that was voted on at select companies in the S&P 1500. The data shows MFS voted for a majority of these proposals.[1]

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.

[1] Georgeson's 2018 Annual Corporate Governance Review, in partnership with Proxy Insight Ltd.

[2] Spencer Stuart report link: https://www.spencerstuart.com/-/media/2018/october/ssbi-2018-final.pdf