In partnership with

Executive Summary

In this report, we share observations regarding ESG reporting within the financial services sector and provide some guidance for financial services companies to consider for future reporting. Set forth below is an overview of proposals reviewed, followed by descriptions of the Task Force on Climate-related Financial Disclosures (TCFD) framework and Sustainability Accounting Standards Board (SASB) standards.

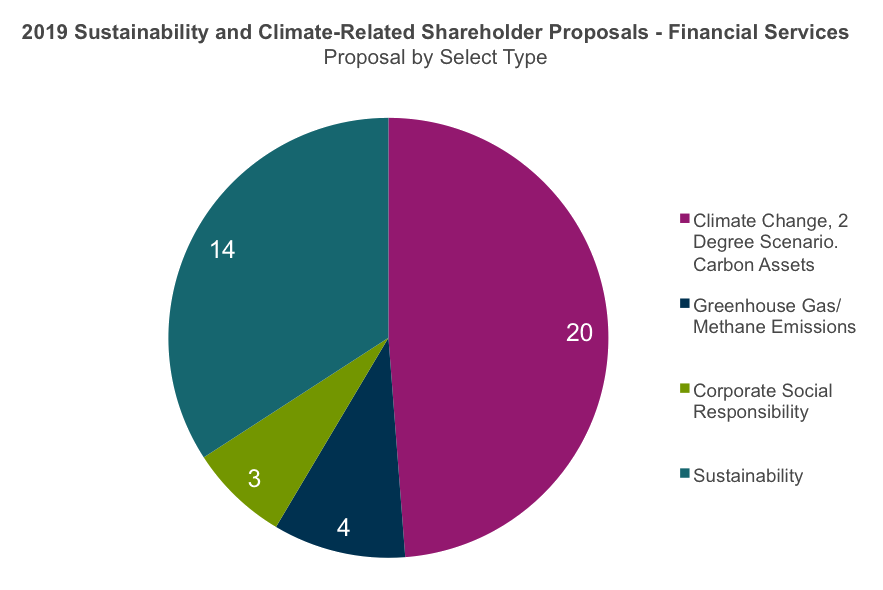

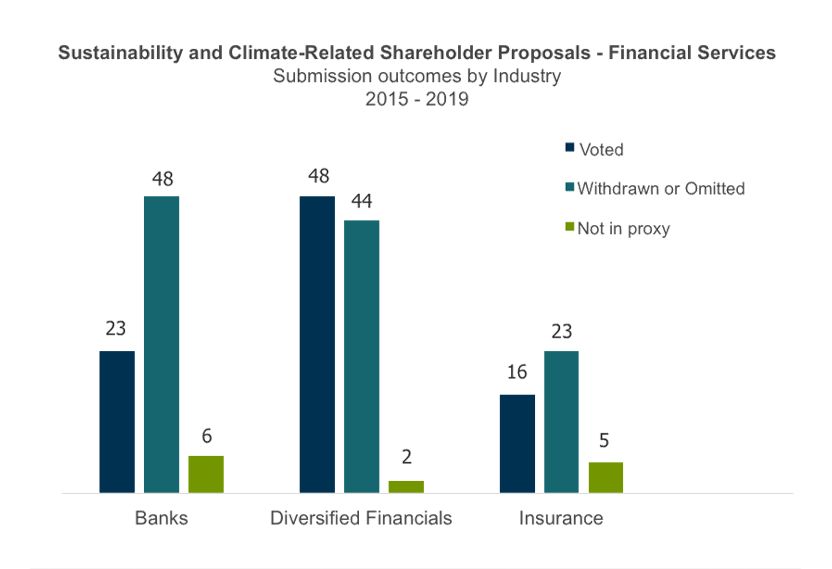

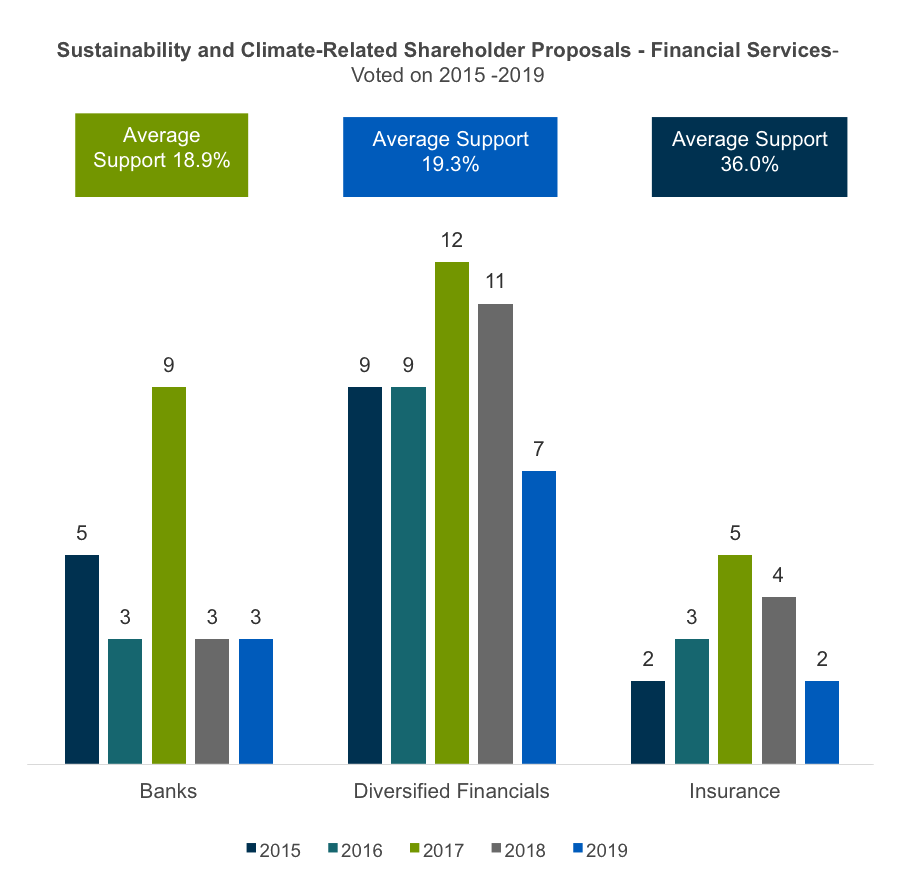

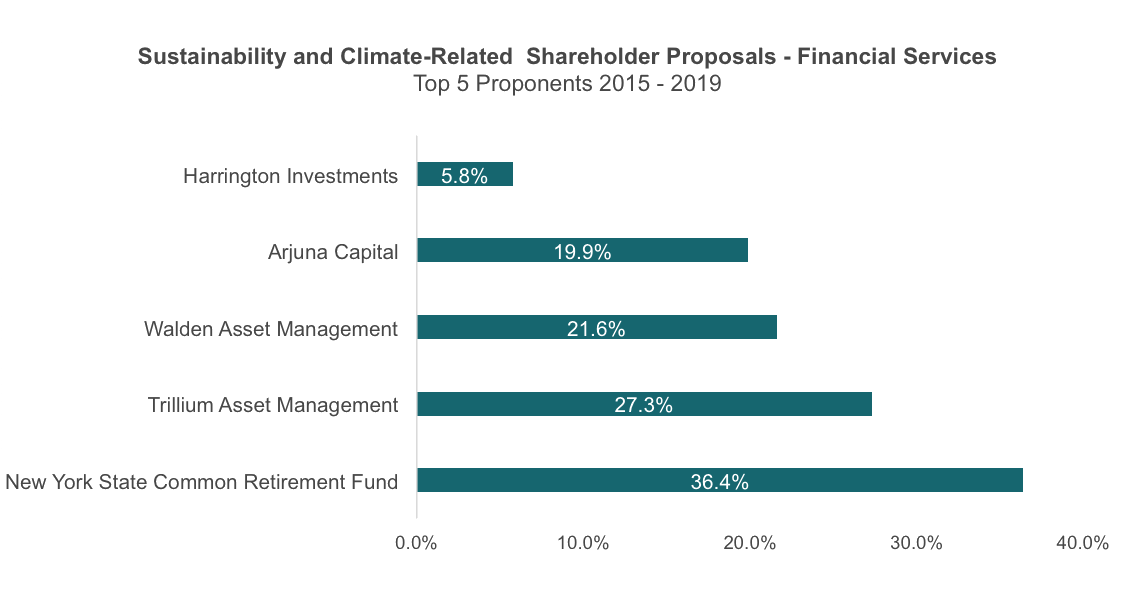

In preparing this report, we reviewed the environmental, social and governance (ESG) shareholder proposals submitted to companies within the Financial Services sector during the last five proxy seasons,1 focusing on proposals related to sustainability reporting/target-setting.2 We then narrowed our focus to the 2019 proxy season. Accordingly, we reviewed the sustainability reports and other ESG disclosures that financial services companies published in 2019 – following receipt of a sustainability-related shareholder proposal – to identify the ESG focus areas included in these reports. We found that although the existence of ESG disclosure did not shield issuers from receiving sustainability-focused shareholder proposals, companies that referenced or committed to aligning annual sustainability reports with investor-favored third-party reporting frameworks such as the TCFD were more likely to have sustainability reporting/target-setting proposals withdrawn.

Environmental/Sustainability Shareholder Proposals in the Financial Services Sector Proposals (2015 to 2019)

A Brief Overview of TCFD and SASB: Industry-specific Frameworks and Reporting Metrics

TCFD Commitment in Financial Services

The TCFD is sponsored by the Financial Stability Board (FSB). In June 2017, the TCFD released its recommendations for voluntary climate-related financial disclosures with the goals of creating a consistent and comparable framework to provide decision-useful information to investors across four main categories: Governance, Strategy, Risk Management, Metrics and Targets. Beyond looking at the environmental footprint of a company's operations, the TCFD framework encourages companies to disclose the potential financial impact of climate-related issues on the financial services sector's core revenue sources such as investing, lending, and insurance products. Part of the framework encourages companies to assess their business strategies in the context of different climate scenarios that align or fail to meet the targets set out in the 2015 Paris Agreement.

According to the 2019 TCFD Status Report, more than 340 investors with nearly $34 trillion in assets under management have committed to engage the world's largest corporate greenhouse gas emitters. The purpose of the engagement is to strengthen the companies' climate-related disclosures by implementing the TCFD recommendations as part of Climate Action 100+ initiative. Of particular note for the Financial Services sector, the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), comprised of 36 central banks and supervisors and six observers, released a statement calling on all financial sector institutions to follow the TCFD reporting framework. Of the 785 companies and other organizations that have publicly committed to TCFD reporting, 374 (48%) are from the financial sector. Subsequent to publication of the 2019 Status Report, in January 2020 BlackRock, the largest global asset manager measured by assets under management, became a signatory to Climate Action 100+, bringing the assets under management committed to strengthening climate-related disclosures to $41 trillion.

SASB: Reporting on Material Metrics and Performance

The Sustainability Accounting Standards Board (SASB) has developed a set of 77 industry specific-standards for companies to communicate sustainability information that investors deem to be financially material. SASB released updated industry-specific reporting standards in November 2018 that categorize the material metrics per industry by a high-level primary Sustainable Industry Classification System (SICs) sector and then a sub-category of primary SICs industries. Financials is a primary SICs sector, with more detailed reporting metrics for specific industry sub-category industries such as commercial banks, consumer finance, investment banking and brokerage.

Within its guidance, the TCFD framework references SASB as an aligned, sector-specific methodology to communicate sustainability information. SASB uses accounting metrics to measure how a company manages climate-related risks and opportunities. For the financial services sector, SASB addresses relevant climate-related business topics such as product design and lifecycle management, systematic risk management, physical impacts of climate change, and data security. SASB standards were published in 2018. Consequently, it is still early days in assessing the appropriateness of the topics and metrics selected for the purposes of understanding the financial implications of these topics. However, anecdotally, in one recent study that used the SASB standards to analyze data from 100 global commercial banks, a portfolio of banks with top scores on SASB topics outperformed the bottom-scoring portfolio on those topics by 2.65 percent in terms of average risk-adjusted returns.

ESG Reporting in Financial Services

In our review of S&P 1500 financial services companies that received environmental proposals in 2019, we identified the following key takeaways from the companies' approaches to ESG disclosures:

- ESG reporting following withdrawn proposals: In two of the three instances where a proponent withdrew its environmental-related shareholder proposal during the 2019 proxy season, we noted that the issuers (which already disclosed some ESG information) subsequently published their first TCFD-aligned reports. The third issuer, which did not appear to have previously disclosed sustainability information, published its first sustainability report subsequent to withdrawal of the proposal. Although this is a small sample size, the sequence of events aligns with increasing investor preference for reporting aligned with the TCFD framework and SASB standards. Investors seem to prefer these reporting frameworks firstly because they are seeking progress from issuers in disclosing information regarding their sustainability-related policies and practices. And ultimately, investors seek comparable and specific information from companies on how they are addressing risks posed by climate change and preparing for a transition to a low-carbon economy.

- Track record of reporting: All but one of the companies that received a shareholder proposal during the 2019 proxy season published a stand-alone ESG or sustainability report in 2019. In particular, we note that issuers that received no-action relief had already disclosed significant ESG information. While reporting varied, examples include stand-alone TCFD reports or references to TCFD within the primary ESG disclosure, as well as full SASB-aligned reports or stand-alone SASB indexes. Many of these companies have an established history of ESG reporting going as far back as 2006. This finding is consistent with the broader reporting practices of 86% of the S&P 500 companies that published sustainability reports in 2018.

- Other standards: In addition to TCFD and SASB, other standards such as the United Nations Sustainable Development Goals, the Global Reporting Initiative (GRI), and Science-Based Targets are referenced in the main ESG disclosure or included as part of stand-alone indexes published separately by issuers.

- ESG leadership focused strategies for key stakeholders: Consistent with the Business Roundtable's Statement on the Purpose of a Corporation, the ESG reports reference a broad set of stakeholders that were considered in developing report content. These include shareholders, employees, customers, communities, policymakers, and research analysts. The focus on ESG leadership addressing key stakeholders is likely here to stay. For example, BlackRock Chairman and Chief Executive Office Larry Fink's recently published 2020 annual letter to portfolio companies called on those companies to align ESG reporting with SASB and TCFD.

- Best-in-class ESG reporting practices: Consistent elements of strong ESG disclosures typically include the following:

- A clear description of how ESG is integrated into the company's business strategy

- Leadership commitment to ESG (often including a letter or statement from the CEO)

- Board and executive level oversight of ESG, and specific initiatives and metrics that highlight ESG achievements

- These disclosures often include integrated or stand-alone mapping documents that link disclosures to topics included in frameworks such as SASB and TCFD

ESG Reporting and Preparing for the 2020 Proxy Season

As companies prepare their sustainability-related disclosures for the 2020 proxy season – and beyond – we believe these findings are instructive. Specifically, these companies have chosen to craft their ESG disclosures with reference to TCFD and SASB, consistent with the preferences increasingly articulated by investors. We expect these calls will accelerate as other asset managers follow BlackRock's explicit request for companies to produce SASB- and TCFD-aligned disclosure, and warning that it will be increasingly unsupportive of management come annual meeting time where disclosure progress has not been made.

Notwithstanding investors' now explicit requests for SASB- and TCFD-aligned disclosure, most companies that structure their sustainability reporting using a voluntary framework continue to use the GRI Standards for their reporting.1 2 We believe investors' SASB and TCFD 'signal' in the ESG noise presents opportunities for differentiation and leadership among small and mid-cap financial services companies. While frameworks such as GRI may be appealing to broader stakeholders, investors seeking comparability and financially material information may find the breadth of data and narrative such frameworks cover less relevant for their purposes. SASB and TCFD offer a manageable, targeted set of topics deemed material by investors that companies can prioritize for purposes of developing ESG disclosures. Concentrating on a targeted set of topics may facilitate companies' abilities to build the consensus across their organizations necessary to achieve internal buy-in on the benefit of ESG reporting.

In addition, these two frameworks also may offer an increasingly important driver of value. As noted in our earlier discussion of SASB, Global Alliance for Banking on Values' (GABV) recent study among financial services companies found that differentiated performance appears to be more pronounced where companies focus on 'material' ESG issues per the SASB materiality map. Specifically, it reported that "adopting a strategic focus on ESG issues can lead to financial outperformance. We have found that commercial banks that score high on material ESG issues have better future performance than commercial banks that score low on the same issues." This is not to say that focusing on the broader issues covered by the GRI is value destructive. Rather, the GABV study indicates the valuation benefit is less pronounced, suggesting the time and effort needed for broader GRI reporting does not have a meaningful financial benefit among commercial banks.

Lastly, although fulsome ESG disclosure does not necessarily prevent financial services companies from receiving sustainability-focused proposals, proactively disclosing this information does appear to offer a means to respond compellingly to such proposals. Furthermore, if such proposals do make their way onto a company's annual meeting agenda, the institutional investors that drive the voting outcomes at many companies are much less likely to support a shareholder proposal such as those examined in this paper if the company in question has already provided fulsome disclosure under a framework such as SASB or TCFD.

1 Proxy season activity data represents voting for the twelve-month period ending June 30 of each year (e.g., 2019 data reflects voting results from July 1, 2018 – June 30, 2019).