The 26th meeting of the UN Conference of the Parties (COP26) led to several newsworthy developments, with companies, countries, and coalitions announcing various initiatives and pledges throughout the thirteen-day meeting. We found the two below especially significant:

- The announcement of interim targets from the Net Zero Asset Managers Initiative (NZAM), and

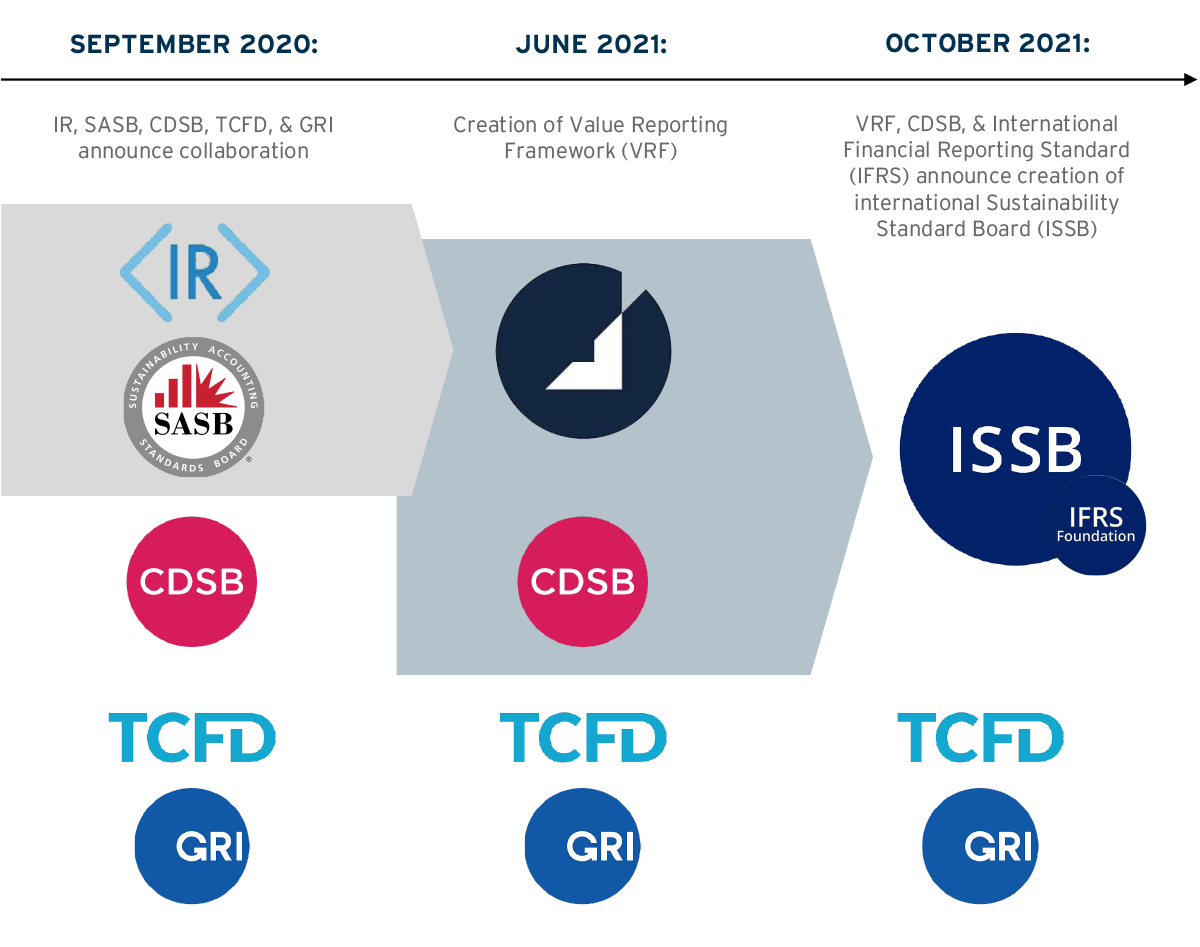

- The formation of the International Sustainability Standards Board (ISSB), and the subsequent consolidation of the Value Reporting Foundation (VRF) and the Climate Disclosure Standards Board (CDSB).

In this report, we highlight the potential impacts these developments might have on the broader corporate landscape. Generally speaking, we expect consolidation of standard-setters and heightened focus from asset managers will raise the bar for companies both as it relates to data disclosure and target setting.

NZAM Disclosed Initial Targets

The Net Zero Asset Managers initiative is composed of 220 signatories, representing over $57 trillion in asset under management (AUM) globally, who have committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner. As part of this initiative, asset managers must disclose:

- The initial percentage of their assets under management that will be managed in line with net zero, and

- The "fair-share" interim targets for the AUM that will be managed in line with net zero and target date.

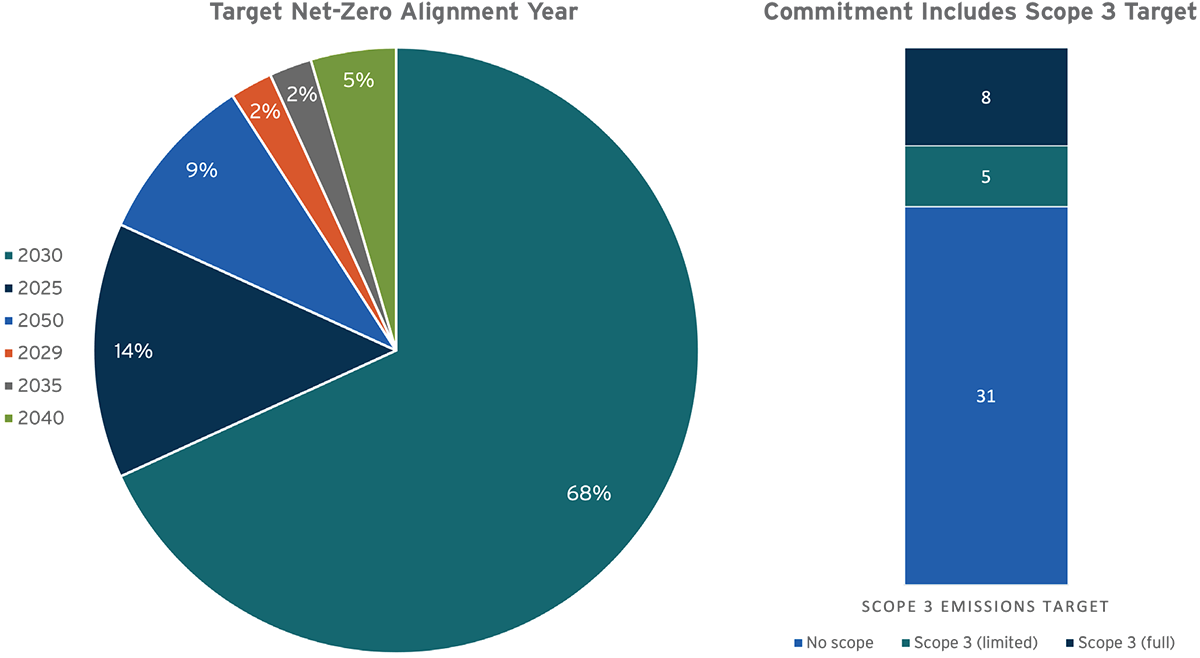

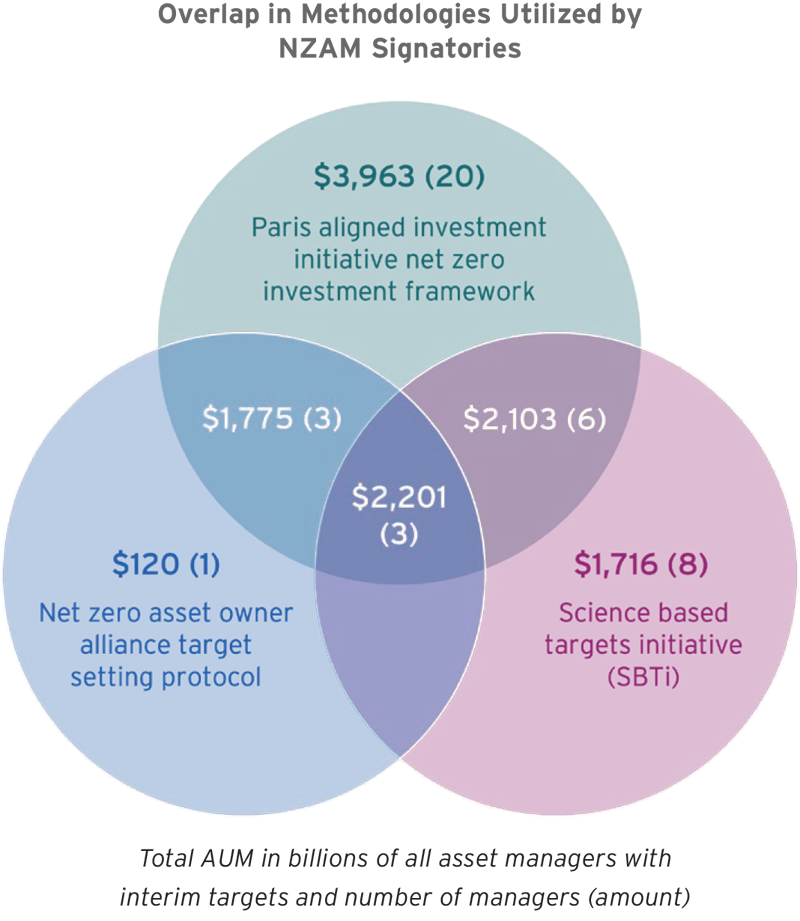

NZAM's 2021 Progress Report, issued during COP26, disclosed interim targets for 43 signatories. The report details the first disclosures for NZAM, as signatories are required to disclose interim targets within twelve months of signing onto the initiative. The targets commit approximately $4.3 trillion in AUM out of a total $11.9 trillion AUM across the 43 signatories to be managed in line with net zero. This translates to approximately 35% of AUM already being managed in-line with net zero across the 43 signatories.

We view the interim targets from members of NZAM as a precursor for what's to come in the asset management industry. Although these targets vary and represent only the first formal commitments of a small subset of the initiative's members, we expect more robust goals to evolve. As an example, most commitments by signatories currently focus on Scope 1 and 2 emissions. Many asset managers specifically note the intent to include Scope 3 over time. Currently, only 18 of the 43 signatories have set net zero targets aligned with the Science Based Targets initiative (SBTi), though we note that the SBTi is developing specific standards for setting net zero science-based targets for financial institutions.

Given the current variance among NZAM signatories in commitments and disclosed goals, context and insight are necessary when determining how an investor's targets might affect their portfolio holdings, engagement, and proxy voting. It is not enough to know how much of an investor's portfolio is, or will be, aligned with net zero. Consider an asset manager that has committed to manage 75% of its AUM consistent with the net zero goals by 2030. The impacts of this commitment will vary depending on the portfolio’s original asset mix. For example, if Portfolio A has 75% of its holdings in renewable energy and 25% in coal-fired generation, adhering to this goal will not require significant changes to asset mix. Using the same goal on Portfolio B, which has 75% of its holdings in coal-fired generation and 25% renewable energy, would likely require significant divestitures, given the portfolio's heavy weighting towards fossil fuels.

Formation of the International Sustainability Standards Board

Another key development during COP26 was the International Financial Reporting Standards (IFRS) Foundation's announcement of the formation of the International Sustainability Standards Board (ISSB). In its announcement, the IFRS Foundation noted three key developments:

- The formation of a new ISSB to develop a comprehensive global baseline of sustainability disclosure standards;

- A consolidation of the Climate Disclosure Standards Board and the Value Reporting Foundation by June 20221; and

- The publication of prototype climate and general disclosure requirements developed by the Technical Readiness Working Group (TRWG).

The formation of the ISSB will likely lead to formalized global sustainability disclosures and standards; this may result in more uniform and consistent ESG reporting, particularly across sectors. Currently, ESG disclosures from U.S. companies are done on a voluntary basis, with little guarantee of comparable and consistent data within the sector. While we expect greater uniformity and consistency in reporting, we note that IFRS is not the accounting standard-setting body in the U.S., which could raise questions surrounding how U.S. companies and investors ultimately adopt ISSB standards.

The large number of standards and frameworks within the broader ESG landscape can create challenges for companies that must report under several frameworks and for investors who must interpret disparate data. In our view, global, integrated standards may ease some corporate reporting requirements; however, increased transparency and uniformity will likely require more robust corporate messaging on ESG approaches and progress.

Increased consolidation of voluntary sustainability frameworks utilized by investors

Ultimately, formal disclosures and standards, combined with heightened investor focus, will likely result in a continuously advancing cycle. Uniform standards should result in more transparent and robust data, which will further inform investor engagement.

Industry-Relevant Developments

In addition to the globally relevant updates, we highlight notable sector-level developments.

Global Methane Pledge

- One hundred five countries joined the Global Methane Pledge, a commitment to cut, by 2030, global methane emissions by at least 30% from 2020 levels. Signatories of the non-binding agreement represent about 40% of global methane emissions.

- Methane (CH4) is a more potent greenhouse gas than CO2, responsible for around 30% of warming, primarily driven by the agriculture, natural gas distribution and waste industries.

- The Biden Administration plans to require emitters to pay a methane fee of $900 per ton of leaked CH4 starting in 2024, increasing to $1,500 per ton by 2030.

Deforestation and Land Degradation

- One hundred thirty-four countries signed a pledge to end deforestation and land degradation by 2030. Countries supporting the Glasgow Leaders' Declaration on Forests and Land Use represents 85% of global forests. Governments and financial institutions pledged $19.2 billion to support the initiative

- Thirty financial institutions representing $8.7 trillion in assets under management committed by 2025 to phase out of their portfolio deforestation driven by agricultural commodities.

Transportation

- Over 100 parties (governments, cities, and businesses) signed the Glasgow Declaration on Zero-Emission cars and vans to end the sale of internal combustion engines by 2034 in leading markets and by 2040 worldwide. Among large automotive manufacturers, General Motors, Ford, Volvo, and Daimler joined the pledge.

Carbon Credit Market

- Approximately 200 countries will implement Article 6 of the Paris Climate Agreement to create a global carbon market, worth potentially $100 billion per year. This will establish the framework for a supervised and centralized marketplace open for public and private sector entities, and a separate bilateral system for countries.

- A boom in the trading of emissions credits is expected, as funds flow into market mechanisms that generate credits, which in turn will be bought by companies or countries looking to offset their emissions.

Recommended Corporate Activity in Response to COP26

We expect corporations to experience heightened scrutiny by institutional investors. Consolidation around ESG standards should further align expectations and enable a push towards target setting, particularly for sectors in the energy sectors. Issuers that have yet to develop an ESG strategy that considers both short- and long-term implications should prioritize doing so.

Some initial steps that issuers can take to accelerate the development of an ESG strategy include:

- Benchmarking current disclosure against the frameworks underpinning the ISSB and the activities of peers.

- Establishing a baseline using the public reporting of relevant peers and the standards favored by investors can help inform both short-term and long-term actions.

- While most ESG issues are reported voluntarily, investors have signaled that they will continue to scrutinize companies on their approach or lack of disclosure.

- Increased ESG disclosure compared to peers provides an opportunity for positive differentiation; proactive disclosure could also help prepare for changes to the regulatory environment.

- Establishing emissions inventory baseline and setting climate goals that are informed by the Science Based Target initiative (SBTi) and aligned with 1.5°C global target.

- Tracking and reporting emissions data requires both an effective system for collecting information, as well as specialized skillsets for interpreting the data collected.

- Investors aspiring to achieve a net zero portfolio will expect issuers to report reliable and accurate emissions data aligned with their own net zero commitments.

- During COP26, the SBTi announced that over 1,000 companies have committed to science-based targets aligned with 1.5°C, and that significant funding has been secured to expand its reach and impact over the next three years.

- Engaging investors proactively on low carbon transition plans and ESG strategy.

- Developing effective reporting aligned with investor-focused frameworks (e.g. SASB, TCFD) and reporting progress to investors on how ESG is being implemented is a crucial part of any ESG approach.

- Transitioning to net zero is a process and each issuer's strategy will be unique to their competitive environment.

- Demonstrating progress and discussing strategy, particularly for companies in carbon-intensive industries, is critical to do with any major investor, especially those involved in NZAM.

For more analysis on how the recent developments at COP26 may affect your company, or to better understand the rapidly adapting ESG landscape, contact Georgeson and HXE Partners.

If you have questions or comments, please email info@georgeson.com or call (212) 440-9800.

1The Value Reporting Foundation is the entity that oversees the Sustainability Accounting Standards Board and Integrated Reporting framework.