Key Takeaways:

- California's “Climate Accountability Package” (SB-253 and SB-261) represents a significant shift in what companies will have to report on climate, including granular GHG data that has been assured and TCFD aligned reporting.

- Companies who have not begun working on climate are advised to start soon, as it can take easily 24-months to prepare for disclosure.

In October 2023, California enacted two landmark laws as part of a “Climate Accountability Package.” The “Accountability Package” aims to significantly enhance corporate transparency and accountability in relation to greenhouse gas (GHG) emissions and climate-related financial risks for companies “doing business in California.”[1] These two laws are the Climate Corporate Data Accountability Act (SB-253) and the Climate-Related Financial Risk Act (SB-261). Together, SB-253 and SB-261, represent a critical development for company reporting on climate. While other regulations have been proposed for public companies and companies operating in the EU, the inclusion of private companies differentiates these California laws.[2] [3]

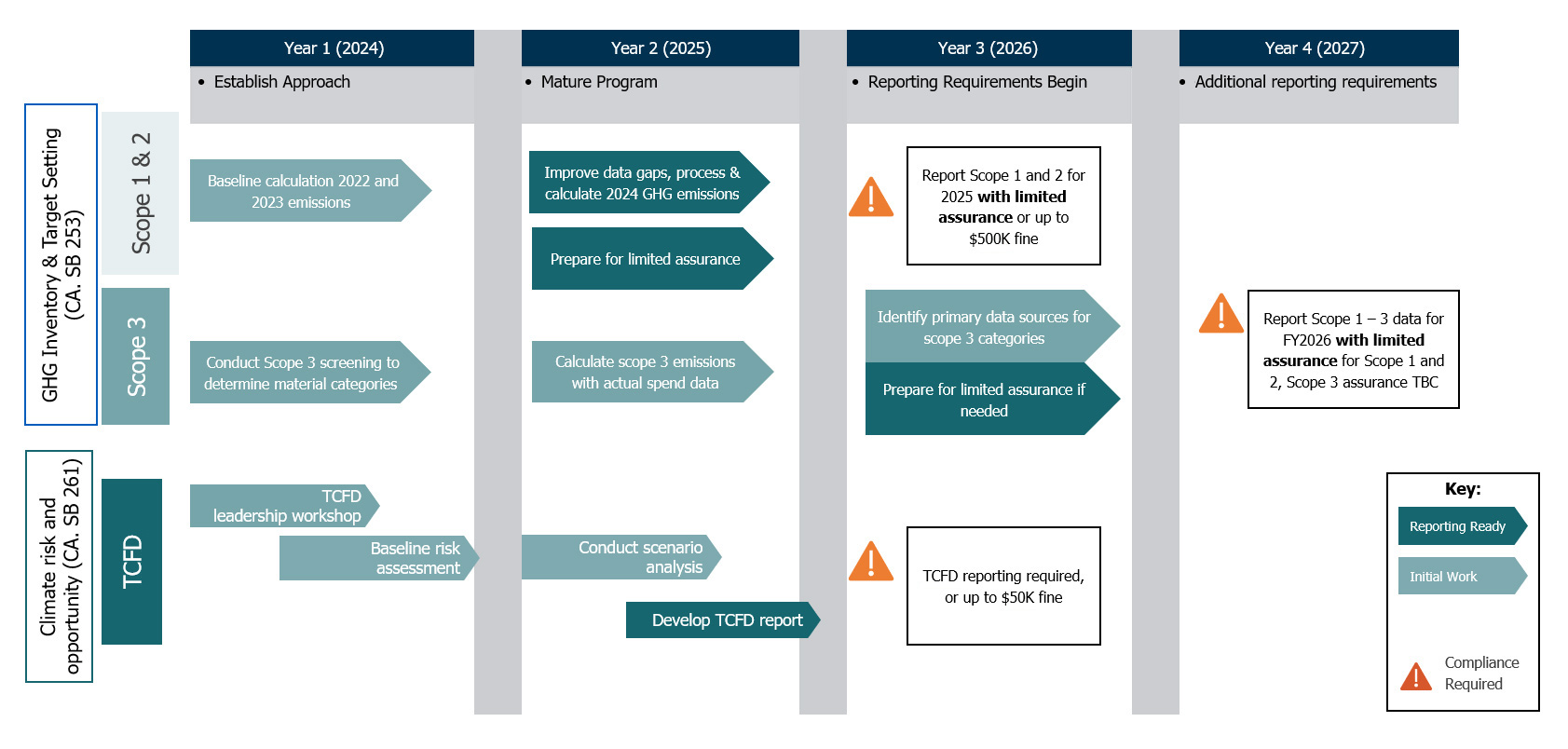

While companies have time before reporting is required, disclosure covers preparation such as collecting granular GHG data, adapting governance and oversight, and conducting climate scenario analysis. For companies not already taking action on these topics it can easily take 24-months. A suggested timeline for action is detailed below for when certain steps should be accomplished.

Comprehensive GHG Emission Reporting: SB-253

The Climate Corporate Data Accountability Act (SB-253) mandates that all companies, public and private, doing business in California with over $1 billion in annual revenue disclose their GHG emissions from Scope 1, 2, and 3 sources. The Accountability Act further requires third-party assurance of these disclosures. SB-253 is perceived to be “the strictest corporate emissions disclosure requirements in the U.S. – even stricter than the Securities and Exchange Commission’s (SEC’s) proposed climate disclosure rules.” More than 5,000 companies are expected to be subject to the requirements under SB-253.

Background on Scope 1, 2, and 3:

- Scope 1 emissions: direct emissions from owned or controlled sources.

- Scope 2 emissions : indirect emissions from the generation of purchased or acquired electricity, steam, heat, or cooling.

- Scope 3 emissions: all other indirect upstream and downstream emissions from a company’s supply chain.

The reporting timeline for SB-253 is phased in over two years beginning in 2025, providing businesses with a transition period to adapt to the new requirements.

Timeline:

- January 2025: State deadline to have the regulation in place in order to provide guidance on specifics of reporting

- January 2026: Scope 1 & 2 reporting assured by independent third-party

- January 2027: Scope 3 disclosure required, in addition to scope 1 & 2. Given the complexity of Scope 3 disclosure the law provides an additional 180-day grace period for disclosure.

Climate-Related Financial Risk Disclosures

The Climate-Related Financial Risk Act (SB-261) complements the GHG disclosure requirements by mandating that companies (private and public) doing business in California with over $500 million in annual revenue disclose their climate-related financial risks and the measures they are taking to mitigate those risks. This disclosure aligns with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), an industry-led framework for companies to assess and manage climate-related financial risks. The law requires companies to prepare and publicly disclose reports on their climate-related financial risks, including potential physical and transition risks arising from climate change.

More than 10,000 companies are expected to be subject to the requirements under SB-261. First reports are required by January 2026, and biennially thereafter.

Enforcement Mechanisms

Both the SB-253 and SB-261 establish penalties for non-compliance.

- SB-253 authorizes the state board to impose administrative penalties of up to $500,000 for non-filing, late filing, or failure to meet the requirements.

- SB-261 allows the state board to levy administrative penalties of up to $50,000 for reports that are not publicly available or do not meet the adequacy standards.

This notice is provided by Georgeson for general informational purposes only and is not intended and should not be construed as legal, regulatory, financial or tax advice. Georgeson is not licensed or authorized to practice law in any jurisdictions and hence does not provide any legal advice and it does not hold itself out as doing so. Neither Georgeson nor any of its affiliates or contributors accept any responsibility or liability for the quality, accuracy or completeness of any information contained in this notice. It is important that you seek independent professional advice relating to the subject matter of this notice before relying on it.

1 EUR-Lex - 32014L0095 - EN - EUR-Lex (europa.eu)

2 Corporate sustainability reporting (europa.eu)

3 Mayer Brown, “Are You “Doing Business” in California?,” 2021: Link - mayerbrown.com