In January 2019 Fidelity Investments (FMR) issued its 2019 Proxy Voting Guidelines. Fidelity's 2019 guidelines included several revised policies, demonstrating its evolving focus on director elections, compensation practices, environmental and social issues and anti-takeover provisions.

This report summarizes Fidelity's 2019 Proxy Voting Guidelines and provides insight into Fidelity's historical annual meeting voting activity.

2019 Proxy Voting Guidelines

New this year, Fidelity's proxy voting guidelines begin with an expanded introductory section that lays out the purpose and intended use of the polices and details how the guidelines are animated by two fundamental principles the firm adheres to in voting proxies:

- Putting first the long-term interest of customers and fund shareholders

- Investing in companies that create long-term value

Fidelity also refers to remaining focused on maximizing long-term shareholder value, but also taking into consideration potential environmental, social and governance (ESG) impacts.

The 2019 guidelines are divided by topic into the following sections:

| Board of Directors and Corporate Governance | Compensation |

Environmental and

Social Issues |

Anti-Takeover

Provisions | Capital Structure

and Incorporation |

Noteworthy updates to these sections include:

Board of Directors and Corporate Governance

Historically, Fidelity has generally supported director nominees in elections, as showcased in the data below. The table details Fidelity's frequency in voting for director elections for companies in the Russell 3000 over the last four years.1

This year Fidelity has implemented a more clearly defined process by which they will vote against the election of particular directors in certain instances, a move away from their historical use of withholding voting authority.

Election of directors

In its 2019 updated guidelines, Fidelity amended the section on election of directors, which now states that Fidelity will oppose the election of directors for a variety of reasons – previously this policy had stated Fidelity would generally withhold voting authority. An against vote may now be warranted in the instance(s) of:

- Attendance concerns, attending less than 75 percent of meetings in the prior fiscal year

- Boards that are not comprised of a majority of independent directors

- The company fails to act on a commitment to modify a proposal or practice

- Anti-takeover provision is introduced without shareholder approval

Cumulative voting rights

Fidelity expanded its policy on cumulative voting stating they believe this practice "can be detrimental to the overall strength of the board." Therefore, they will continue to oppose the introduction of and support the elimination of cumulative voting rights.

Classified boards

Fidelity also expanded its policy on classified board structure to include their reasoning to vote against adoption of this practice. Fidelity believed that "in general, classified boards are not as accountable to shareholders as non-classified boards."

Independent chairperson

Fidelity amended its policy language around the board's selection of a chairperson, which now states that boards should have a process and criteria for selecting a board chair.

Proxy access

Fidelity updated its policy language on proxy access to stress the importance of having certain safeguards in place to "assure that proxy access is not misused by those without a significant economic interest in the company or those driven by short term goals." These considered safeguards are ownership threshold and duration of ownership. Fidelity will generally support proposals that include ownership of at least 3 percent (5 percent for small cap companies) of outstanding shares held for at least three years.

Compensation

Fidelity's support for say-on-pay proposals has declined slightly over the past four years, showcased below, from 98 percent to 97 percent. However, in their recently published proxy voting guidelines the sections relating to compensation (general compensation and say-on-pay voting) appear to contain the most substantive changes and may more dramatically affect Fidelity's voting support for these management proposals in the future.

The table below details Fidelity's frequency in voting for say-on-pay proposal for companies in the S&P 500 over the last four years.2 They have decreased their support for say-on-pay by 1 percent.

The compensation topics that have been update relate to the following issues:

Burn rates

In the section "Equity Compensation Plan," Fidelity stated it will generally vote against equity compensation plans if a company grants options/ equity awards at a rate higher than a burn rate considered appropriate by the firm. Fidelity did not disclose the relevant burn rate.

Alignment of compensation with performance and disclosure efforts

In the section "Advisory Vote on Executive Compensation," Fidelity details their updated policies on say-on-pay votes. Specifically, they have added a statement which says the firm "believes that compensation should align with company performance as measured by key business metrics" and that "compensation program should be disclosed in a transparent and timely manner." Fidelity did not disclose the key business metrics.

Compensation committee elections

Fidelity will continue to oppose the election of directors on the compensation committee if:

- the company did not adequately address concerns communicated by Fidelity in the process of discussing compensation

- within the last year and without shareholder approval the company has repriced outstanding options or adopted/extended a golden parachute

Environmental and Social Issues

In the section "Environmental and Social Issues," Fidelity now states that in the same manner they express views on corporate governance of a company as intended to maximize shareholder value, they will now incorporate environmental and social issues into their evaluation. As they have disclosed in past proxy voting guidelines, Fidelity may support shareholder proposals calling for reports on sustainability and workplace diversity, among other E&S issues. This evolution is further evidenced in Fidelity's recent voting history.

2017 and 2018 Fidelity proxy voting history

As detailed in our 2017 and 2018 Annual Corporate Governance Review reports, during the 2017 and 2018 proxy seasons, several prominent institutional investors — including Fidelity — appear to have changed their voting policies on environmental and social matters to be more supportive of certain shareholder-sponsored proposals on these issues.

The tables below detail Fidelity's voting history on two recent shareholder proposals voted on at companies in the S&P 1500. The data shows Fidelity voting for these proposals, which we see as a transformation from their previously held position. Historically, Fidelity had voted with management's recommendation against these efforts.

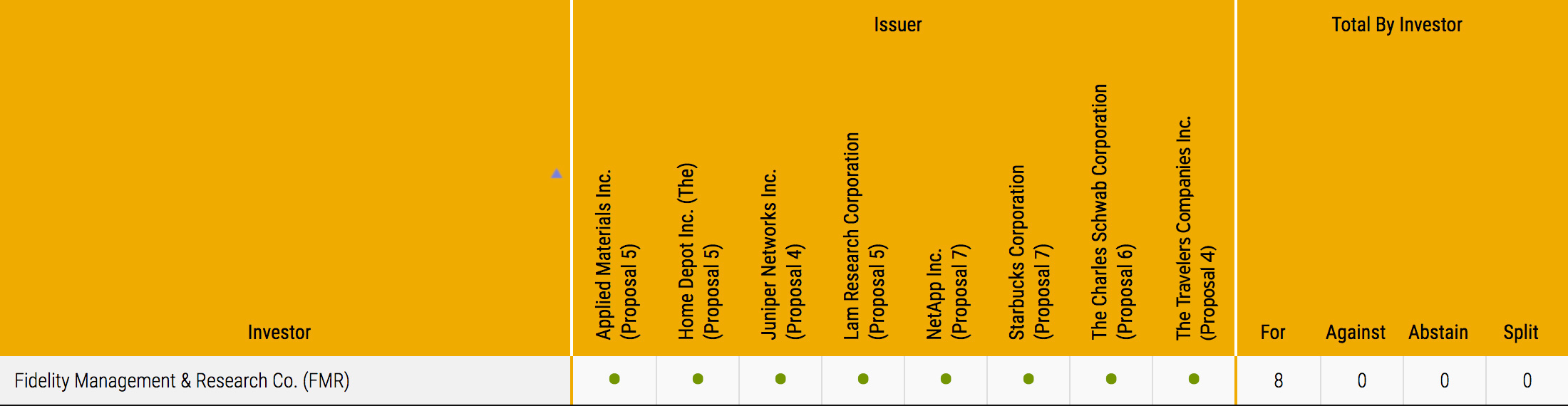

2018 Shareholder Proposal Voting History: Select Employment Diversity Shareholder Proposals3

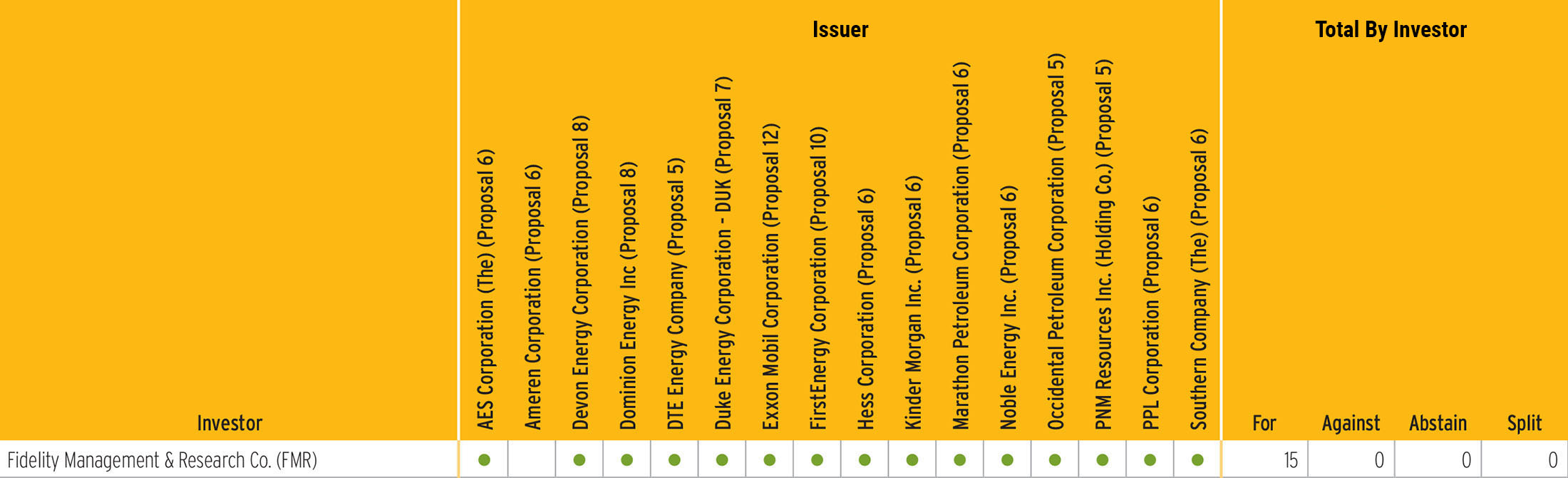

2017 Shareholder Proposal Proxy Voting History: Select Climate Change Proposals4

Anti-Takeover Provisions

In their 2019 proxy voting guidelines, Fidelity expounds on their views on anti-takeover provisions. Fidelity will vote against anti-takeover provisions including the following:

- Classified board;

- Blank check preferred stock;

- Golden parachutes;

- Supermajority provisions;

- Poison pills;

- Restricting right to call special meetings;

- Provisions restriction right of shareholders to set board size; and

- Any other provision that eliminated or limits shareholder rights.

Fidelity will also generally vote against directors responsible for adopting/extending anti-takeover provisions without shareholder approval.

A link to Fidelity's 2019 proxy voting guidelines can be found here.

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.

1,2,3Data provided by Georgeson’s 2018 Annual Corporate Governance Review, in partnership with Proxy Insight Ltd.

4Data provided by Georgeson’s 2017 Annual Corporate Governance Review, in partnership with Proxy Insight Ltd.