Top factors influencing the voting decisions of institutional investors

- Negative ISS or Glass Lewis recommendation

- Recent company events and business developments

- Off season engagement and communication between the issuer and institutional investor

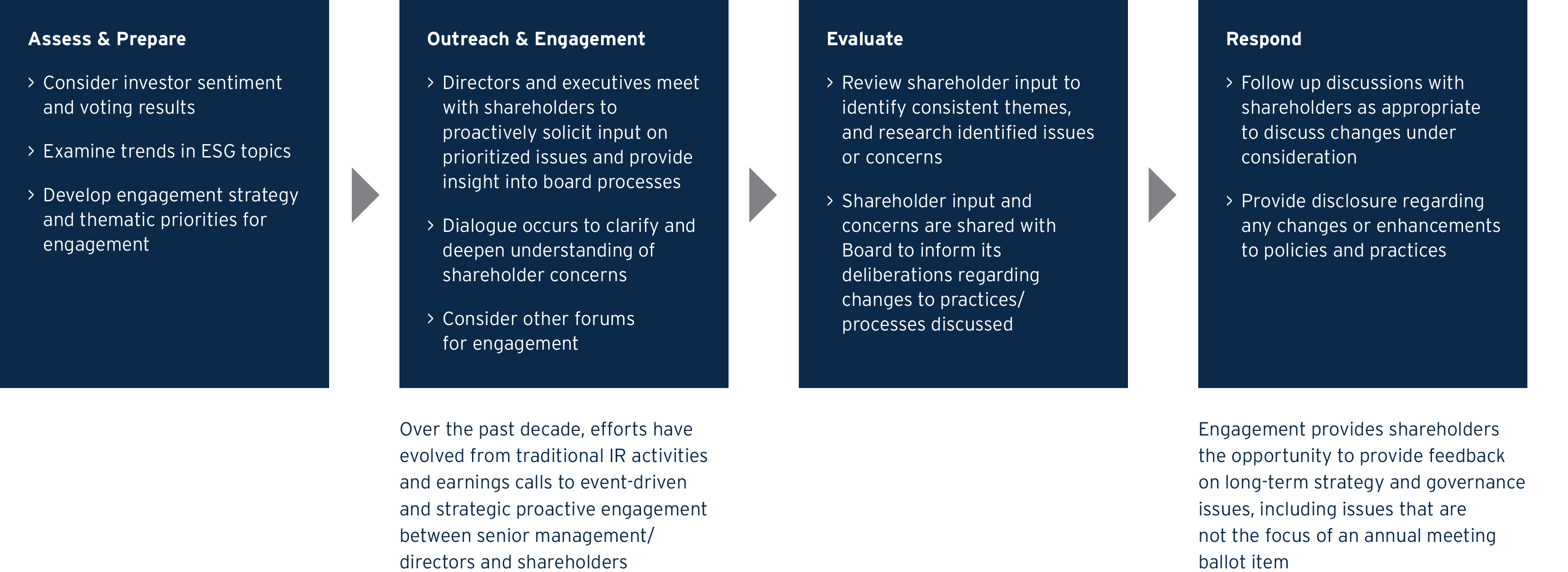

Shareholder engagement has expanded beyond the proxy season to become a year-round strategic endeavor as public companies increasingly seek to engage with investors on governance and other business-related topics. Effective engagement programs allow issuers to develop relationships with governance teams at institutional investor firms, anticipate and prepare for potential issues at the annual meeting and even potentially mitigate or avoid activism scenarios.

Engagement works by giving issuers a heightened understanding of their investor's governance expectations and proxy voting policies as well as an opportunity to build credibility and good will with their investors. However, developing an effective strategy to reach key investors can be challenging for many companies.

It would be a mistake to simply go through the motions to check the box of shareholder engagement. Issuers are well-advised to be thoroughly prepared when engaging investors by creating and presenting the right content, understanding investors' "hot button" issues, identifying the specific areas the issuer would like to better understand investors' view points and knowing who to contact at the firm as well as how to reach them. Importantly, issuers must have a clear understanding of their goals for the engagement — and the investor's goals as well.

How we help

- We analyze your investor base and help you set objectives to develop an engagement strategy

- We develop impactful cross-channel communications designed to effectively engage your investors

- We prepare your team for meetings with investors and proxy advisors

- We compile and synthesize notes so you can focus on the conversation

- We work with you to determine next steps resulting from your meetings

Communicate your message

To develop an articulate message that will resonate with your investors, we conduct a thorough review of your unique situation, issues and goals at the outset to determine your engagement strategy. It is important to have a clear set of goals at the outset of your engagement process, both so your team is prepared and to get the most out of your meeting.

We manage on average 500 annual and special meetings each year in addition to a variety of complex and contested solicitations, so we've seen it all. We'll help you develop and relay information about your proposals and/or corporate governance practices in an effective manner that leads to a productive dialogue with your investors.

Determine the right participants

While your CEO and investor relations department often speak regularly with your investors' portfolio managers, it is often investors' corporate governance teams that make key voting decisions. We have strong, long-standing relationships with the institutional investor community so we know when it makes sense to invite governance teams to your engagement. We leverage our vast database of historical data and analytics on each institution so you gain actionable insights and a better understanding of your investors. We also identify the right individuals from your company to participate, including board members.

Prepare for your meeting

Based on your goals, we help you prepare an agenda for your meetings, and encourage you to ask investors in advance if they have any topics they would like to address. We also leverage our deep knowledge of institutional investors' engagement priorities and voting guidelines to determine who is likely to engage on specific topics — from executive compensation to director elections to environmental, social and governance issues – and provide you with detailed profiles of each investor you will be meeting with.

We make sure your engagement team is thoroughly prepared for your meetings by offering talking points, "hard" questions on topics likely of interest to your investors and preparation sessions to make sure members are comfortable speaking on the topics at hand. If this is not your first meeting with the investors, we also prepare you to discuss progress made on matters discussed in prior meetings.

Action items following your meeting

An effective engagement program begins with well executed meetings, but your actions following these meetings are critical to investors. We will compile and synthesize your meeting notes to identify key takeaways, highlighting trends and other noteworthy feedback in a format you can readily share to facilitate discussion. We are available also to present to your board on your engagement program, shareholder feedback received and suggested areas of focus. We also review your proxy statement to incorporate feedback from shareholders as appropriate, to ensure your engagement efforts are effectively captured and for other enhancements generally.

Get started

Implementing an effective year-round shareholder engagement program creates valuable opportunities for a company to connect with its most influential investors during the "off-season" when the board, management and institutional investors have more time to dedicate to understanding and addressing issues that may have come up during the previous proxy season or may arise during the upcoming season.

Our seasoned team includes former legal, proxy advisor and institutional investor professionals ready to help you develop an effective engagement program that will get results.

Call 212-440-9800 or

email us to get started.