Following the publication of our 2019 Annual Corporate Governance Review, Georgeson is examining select topics in a series of "ACGR Insights" that provide in-depth analysis into select data sets. In our second ACGR Insights report, we review U.S. director election results.

In this report, Georgeson highlights key observations and trends related to U.S. director election results, with a focus on key committee chairs. We have analyzed and compared the vote results since 2015 for both Russell 3000 and S&P 500 companies.1

Key Takeaways

- Support for the key committee chairs at Russell 3000 companies has been declining over the past five years. The greatest declines have occurred for directors who chair the nominating & governance committee (N&GC).

- The key committee chairs2 at Russell 3000 companies receive lower support compared to the board as a whole. The vote for N&GC chair tends to be the lowest and was 3.5% lower than an average director in 2019.

- N&GC chairs at Russell 3000 companies have become increasingly vulnerable and represented almost one out of every five directors receiving less than 90% support in 2019.

- Unlike the Russell 3000, the average support for all directors at S&P 500 companies has remained relatively steady over the past five years. Also, the N&GC chair at S&P 500 companies has not experienced any excessive opposition compared to other committee chairs.

Director Election Results at Russell 3000 Companies

I. Trend of Average Vote Support

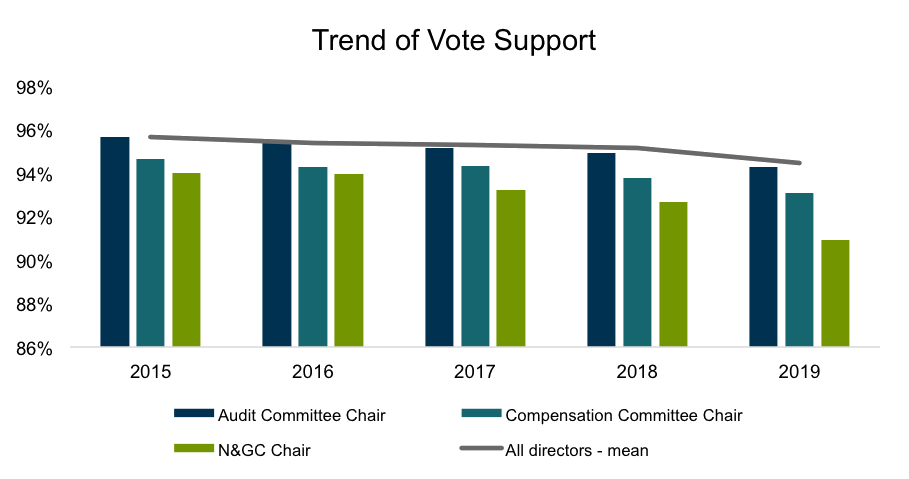

Average vote support for directors at Russell 3000 companies has been gradually declining year-over-year. A similar trend is observed for the key committee chairs as well. Among the three key committees, the decline has been the most noticeable for N&GC chair.

By the numbers:

By the numbers:- Average support for all directors has declined by approximately 1.2% since 2015.

- During the same period, support for the N&GC Chair has fallen by approximately 3.1% or 2.6 times as much as the decline in support for an average director.

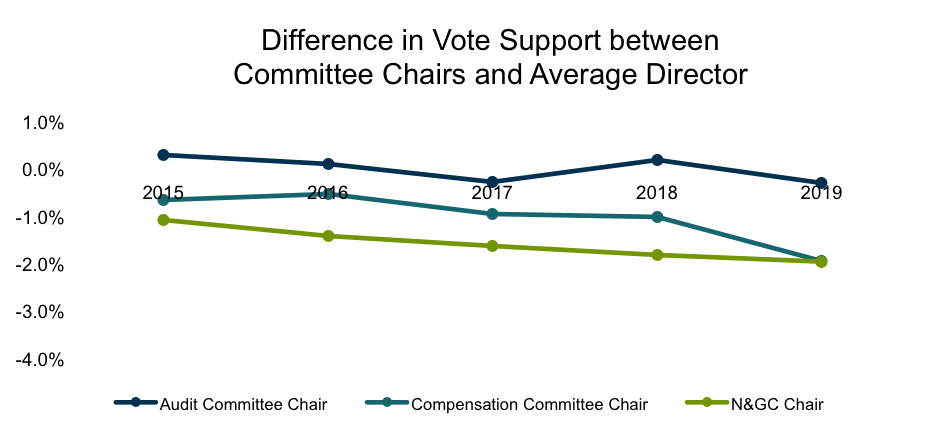

II. Support for Committee Chairs in Comparison to the Board as a Whole

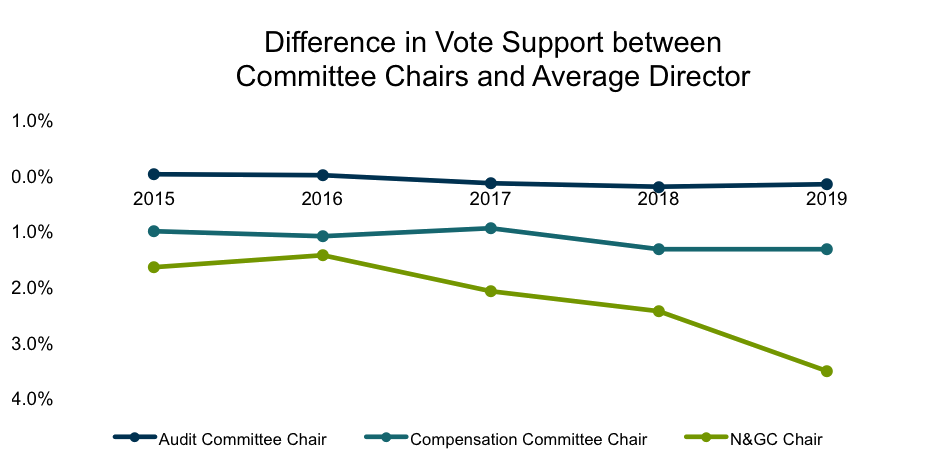

Looking at the difference in vote results indicates that the committee chairs tend to receive lower support than an average director. Of the three key committees, the difference in support is most noticeable for the N&GC chair. Audit committee chair tends to receive almost the same level of support as the board as a whole, while the support for an average Compensation committee chair falls in the middle. The vote gap for the N&GC chair with respect to both the other chairs and average director has widened starting in 2017 and has accelerated in 2019.

By the numbers:

By the numbers:- In 2019, N&GC chair received approximately 3.5% lower vote compared to an average director.

- During 2019, the support for N&GC chair was approximately 2.2% and 3.3% less than compensation and audit committee chairs, respectively.

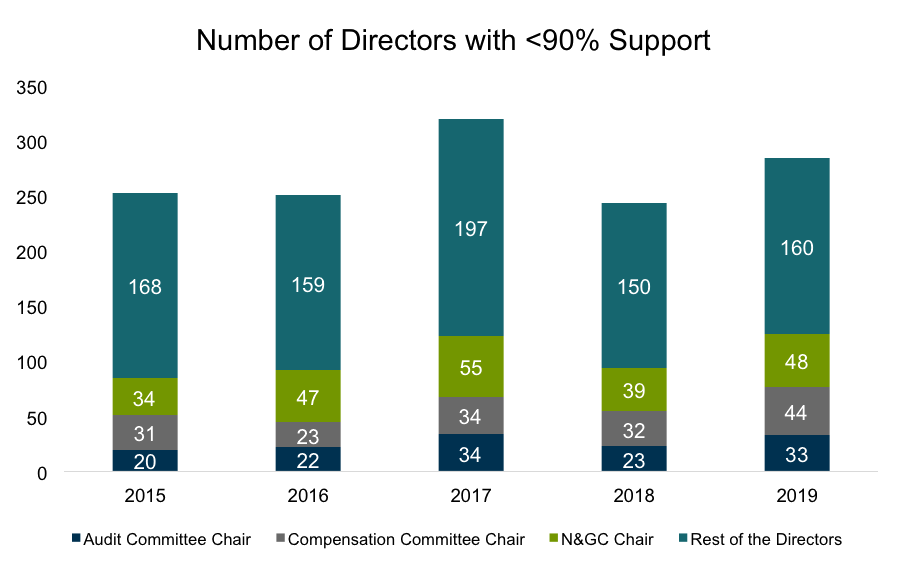

III. Directors Receiving Less than 90% Vote Support

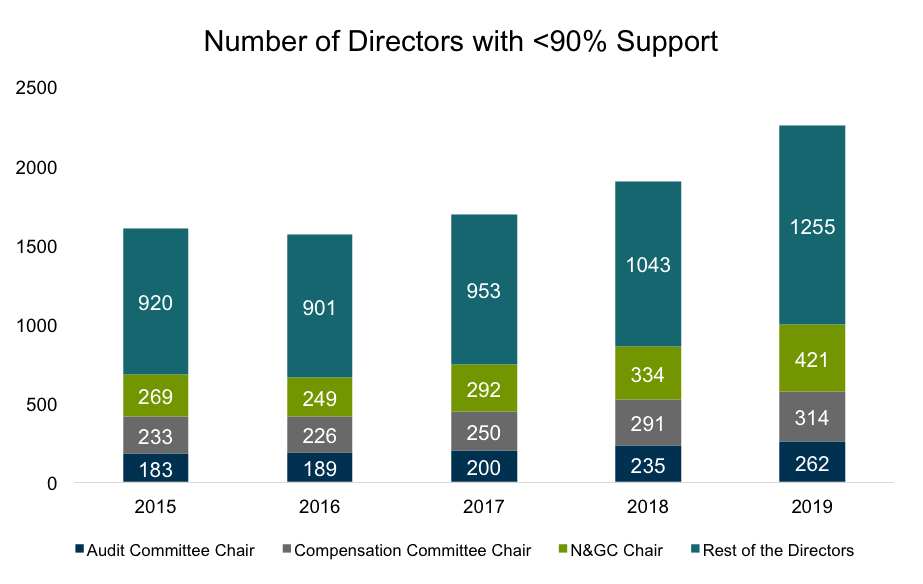

After falling slightly in 2016, an increasing number of directors overall are attracting less than 90% support. A similar trend is observed for the key committee chairs as well. N&GC chairs have become increasingly vulnerable and represented almost one out of every five directors receiving less than 90% support in 2019.

By the numbers:

By the numbers:- In any given year, the key committee chairs have represented greater than 40% of the total number of directors receiving less than 90% support.

- The number of N&GC chairs receiving less than 90% support has increased by approximately 69% since 2016 at a rate of approximately 19% year-over-year.

- In 2019, the N&GC chair was approximately 61% and 34% more likely compared to Audit and Compensation committee chairs, respectively, to receive less than 90% vote support.

Comparison of Vote Support for N&GC Chair by Sector

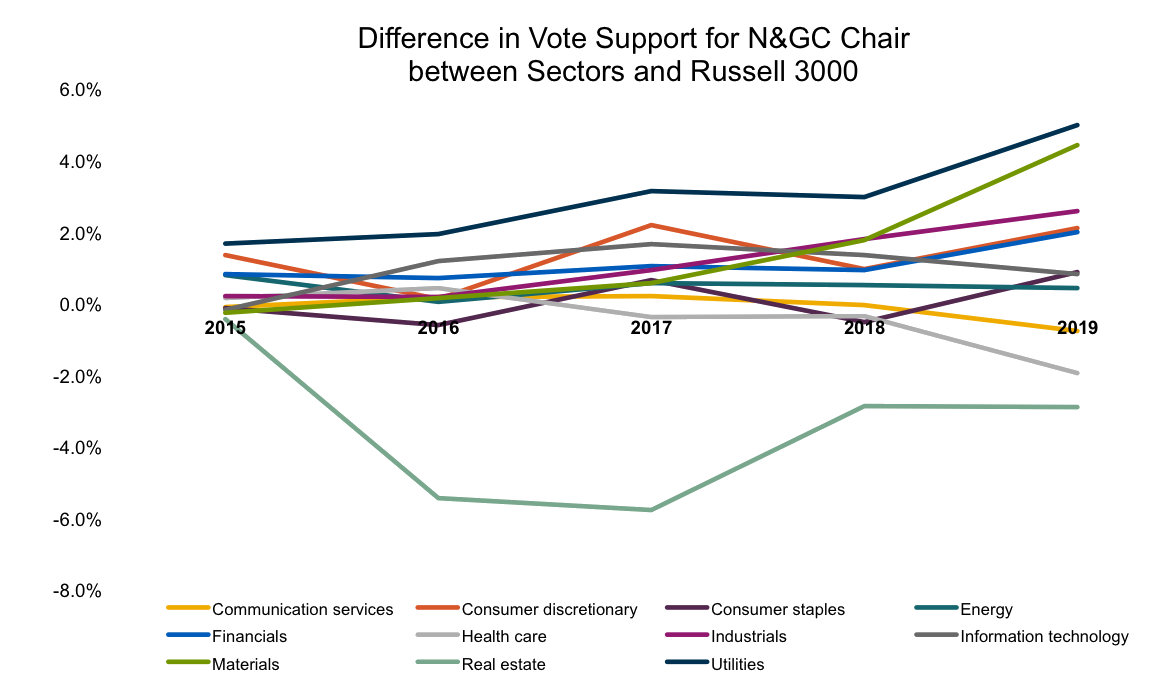

Among the 11 market sectors, support for the N&GC chair at the utilities sector has consistently ranked the highest in any given year, averaging approximately 2% to 5% more than the overall Russell 3000 market index. The high vote is likely reflective of the strong board composition practices that exist at the companies in the utilities sector. According to the "Corporate Board Practices" 2019 report by The Conference Board, the utilities sector ranks at the top with respect to board diversity policies, percentage of women directors, board independence, annual director evaluation and mandatory retirement age3. The real estate sector was the worst performer with its N&GC chair receiving the lowest support each year since 2015. Real estate sector also tends to be a laggard when it comes to board tenure.

By the numbers:

By the numbers:- N&GC chair at utilities sector has averaged approximately 3% higher vote support compared to that of Russell 3000 over the 5-year period.

- Real estate sector N&GC chair averaged approximately 3.5% lower vote support during the same period when compared to Russell 3000.

Director Election Results at S&P 500 Companies

Unlike the Russell 3000, the average level of support for all directors at S&P 500 companies has remained relatively steady year-over-year. While there has been a small decline in support for the three key committee chairs, there is no excessive decline for N&GC chair.

Similarly, when compared to Russell 3000 companies, the N&GC chair at S&P 500 companies does not experience as much of a vote support gap relative to the average director or the other two key committee chairs.

In line with the average support, the total number of directors receiving less than 90% support has remained relatively steady at the S&P 500 companies.

Conclusion

We expect the trends as reflected above to persist in 2020 as pressure on companies increases on issues pertaining to board composition, especially board diversity. In October 2019, New York City Comptroller's office launched its Boardroom Accountability Project 3.0, calling on companies to consider diversity in searches for both new directors and CEOs. Additionally, ISS's updated policy on the matter is to recommend a vote against the chair of the nominating committee at boards that lack a woman director. Investors and the proxy advisory firms are also increasingly holding N&GC accountable in cases of perceived governance failings. Vanguard, for example, adopted a policy in 2019 to vote against the chair of the nominating committee if the board re-nominates so called "zombie" director who failed to receive majority support and underlying issue driving shareholders' opposition to the director remains unaddressed. Given this heightened level of scrutiny, we are likely to see a continued increase in opposition to the chair of the N&GC at Russell 3000 companies in 2020. Contact us today to prepare your engagement plan by emailing info@georgeson.com or calling 212 440 9800.

1 Analysis on director election vote results was compiled with data from ISS Corporate Solutions.

2 Defined as the chairs of the compensation, audit and nominating and governance committees.

3 https://www.conference-board.org/publications/Corporate-Board-Practices-2019