When it comes to ESG ratings, in order for companies to obtain optimum results, directors and management need to know what information rating agencies take into account in determining company scores. These ratings can carry great influence over investors, as well as the public. Inconsistent and low scores may also lead to activist investors, shareholder proposals or even reputational damage – and missed or lost capital investment.

Yet sometimes, despite best efforts, the scores are inaccurate or inconsistent. Companies may believe they’re on the right track, focusing considerable effort and investment on ESG, but still receive low ratings and rankings.

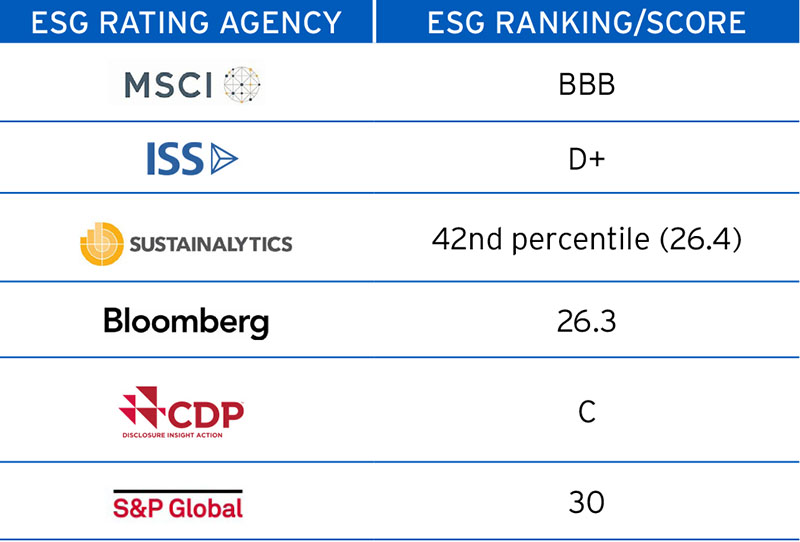

Georgeson’s ESG advisory services help simplify the process and provide the details you need. We help break down and define the many different rankings and scores, giving you valuable insight into what the information means, what matters for your company, and how to improve your scores. Our experts are also here to provide advice on how to improve your current ESG policies and disclosures.