On January 17, 2019, BlackRock issued a letter from Chairman and CEO Larry Fink to CEOs and released its updated 2019 proxy voting guidelines for U.S. securities. On January 22, 2019, BlackRock released its updated 2019 Global Corporate Governance Guidelines & Engagement Principles. This report includes a review of BlackRock's letter to CEOs as well as a summary of the investment manager's noteworthy and significant policy updates.

Larry Fink's 2019 Letter to CEOs

In the letter, titled “Purpose & Profit,” Fink discusses the role that corporations should play in society and commented

on the link between purpose and long-term growth and value creation. Addressing

chief executives, Fink calls upon CEOs to provide leadership and commit to

social responsibilities in a time of increasing market uncertainty and

political dysfunction. Fink writes, “Companies cannot solve every issue of

public importance, but there are many – from retirement to infrastructure to

preparing workers for the jobs of the future – that cannot be solved without

corporate leadership.”

In the letter, Fink highlighted the important societal role corporations must play in the face of divisions that continue to deepen around the world. "Stakeholders are pushing companies to wade into sensitive social and political issues – especially as they see governments failing to do so effectively," Fink wrote. Among other social and economic issues that companies should seek to address, Fink specifically asked companies to embrace a greater responsibility with regards to worker retirement to cultivate a more productive workforce and economically secure population.

Fink writes that understanding and expressing its own purpose should enable a company to drive long-term profitability. Purpose will continue to increase in importance as the world's largest transfer of wealth in history shifts from baby boomers to millennials, who "express new expectations of the companies they work for, buy from and invest in."

As noted in the letter, BlackRock's Investment Stewardship engagement priorities for 2019 include governance, including a company's approach to board diversity; corporate strategy and capital allocation; compensation that promotes long-termism; environmental risks and opportunities; and human capital management. The world's largest asset manager will engage around these issues with a focus on a company's strategy for long-term growth. BlackRock emphasized that robust and year-round communication is the only way, in its view, to make engagement truly effective. More information on BlackRock's Investment Stewardship can be found at https://www.blackrock.com/corporate/about-us/investment-stewardship.

In many ways the letter builds on Fink's 2018 letter "A Sense of Purpose," which is summarized here, and the idea that every company should have a framework to incorporate its purpose into its business model and corporate strategy. Fink clarified that, "We have no intention of telling companies what their purpose should be – that is the role of your management team and your board of directors. Rather, we seek to understand how a company's purpose informs its strategy and culture to underpin sustainable financial performance."

BlackRock will, however, generally vote in accordance with its voting policies. The policies have, according to BlackRock, been written to protect and enhance the economic value of the securities held by clients and summarize its Investment Stewardship philosophy and approach to corporate governance issues.

2019 Proxy Voting Guidelines for U.S. Securities

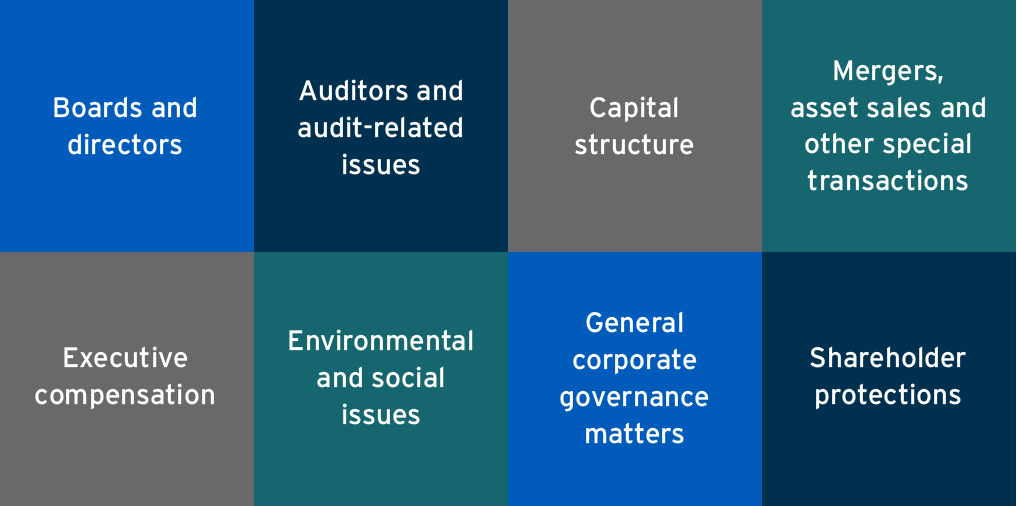

On the same day, BlackRock also released its updated 2019 proxy voting guidelines for U.S. securities. The 2019 guidelines are divided into eight key themes, grouped by issues that frequently appear on shareholder meeting agendas.

Noteworthy updates include:

Board independence

In its 2019 updated guidelines, BlackRock amended the section on board independence, eliminating language relative to directors who are founders, have substantial business or personal relationships with the company or senior executives and, if applicable, relevant family relationships. BlackRock has instead added broader language that any ties that could be perceived to interfere with a director's ability to act in the best interests of the company may cause the director to be deemed non-independent.

Board composition and effectiveness

BlackRock expanded its considerations for a diverse and effective board. In addition to encouraging companies to have at least two women directors on their board, BlackRock also referenced personal and professional qualities, including gender, ethnicity, geographic location, experience and competencies. BlackRock clarified that a company should adequately address board composition diversity "within a reasonable time frame" or BlackRock will vote against the nominating / governance committee.

Classified board of directors / staggered terms

BlackRock reaffirmed its view that directors should be reelected annually, but acknowledged that it may consider supporting potential exceptions to this structure.

Director compensation and equity programs

An addition to the section on non-executive director (NED) compensation clarifies that BlackRock believes that compensation structure should be designed to align with shareholder interests and "… attract and retain the best possible directors…"

IPO governance

BlackRock referenced its April 2018 letter on the treatment of unequal voting structures to reaffirm that its preferred class structure for public companies is "one vote for one share." However, it added language to recognize the potential benefits of dual class share structures for newly public companies – but clarified that these structures should be specific and limited in duration.

Climate risk

Many topics in the "Environmental and social issues" section remain materially unchanged, but BlackRock did amend the climate change section to highlight that, at some companies, it expects the whole board to demonstrate fluency in how climate risk affects the business, and how management assesses, adapts to and mitigates climate risk.

Say on pay

Previously included in its U.S. voting policies, BlackRock's say on pay framework is now found in a separate document, "BlackRock Investment Stewardship's approach to executive compensation."

2019 Global Corporate Governance Guidelines & Engagement Principles

BlackRock's proxy voting guidelines are intended to be read in conjunction with its Global Corporate Governance Guidelines & Engagement Principles. Noteworthy updates to these guidelines and principles include:

Introduction

The language has been updated to focus on its fiduciary duty to help build better financial futures for investors and referenced its prioritization of technology.

Corporate governance, engagement and voting

BlackRock highlighted some factors that drive its voting decisions, including research and analysis and working with active portfolio managers. BlackRock's engagements are also used to inform better its voting decisions. The company views its "engagement-first approach," which emphasizes direct dialogue with companies, as a method to develop a mutual understanding of governance issues, promote best practices and assess the company's overall governance. BlackRock also uses engagements to provide feedback on company disclosure. BlackRock specified that it does not try to micromanage companies and that the materiality and immediacy of a given issue generally determines the level of its engagement.

Boards and directors

BlackRock expanded its expectations for how the board supports and oversees management, adding that the board should help management set long-term strategic goals, metrics for value-creation, milestones to progress and reporting.

The investment manager clarified that a company's lead independent board director should be available to shareholders in situations where a director is best placed to explain and justify a company's approach. This statement replaces the previous expectation that the lead independent board director should be available to shareholders to discuss any concerns.

Capital structure, mergers, asset sales and other special transactions

BlackRock added a new section to outline its policy on dual share classes, reiterating its belief that a one vote for one share approach supports good corporate governance and protects shareholders' interests.

Compensation and benefits

BlackRock clarified that compensation structure should generate sustainable long-term shareholder returns and voiced the concern that the use of peer group evaluation for compensation evaluation may be too narrow in scope. The firm added that non-executive director compensation should be commensurate with time and effort expended to fulfill responsibilities.

Environmental and social issues

BlackRock clarified that all investment stewardship activities are undertaken within the context of the firm's fiduciary duty to underlying clients, and that good environmental and social (E&S) practices may be evidence of a well-performing business model. It further clarified that it considers E&S factors material if they are core to how the business operates – and it expects companies to identify and report on E&S risks.

Reporting and vote transparency

BlackRock added clarity and detail to the vote reporting section. The investment manager referenced direct communications and pointed to its website for voting statistics and records. It also highlighted its quarterly investment stewardship engagement and voting reports and other public disclosures.

Preparing for the 2019 Proxy Season

In his 2019 annual letter to CEOs, Larry Fink asks public company leaders to use their expertise and capacity for innovation to address certain social issues while creating long-term value for stakeholders in a complex and uncertain environment. Fink also expects companies to demonstrate commitment to the communities where they operate. To do so, Fink writes, companies must clearly express and embody their purpose – from business model to corporate strategy to human capital management.

BlackRock's updated 2019 Proxy voting guidelines for U.S. securities and 2019 Global Corporate Governance Guidelines & Engagement Principles reflect some of the stewardship values outlined in the Fink's letter to CEOs. Reflecting wide-reaching governance topics that continue to evolve and will impact the 2019 U.S. proxy season, BlackRock added detail and clarity to its proxy voting approach to matters related to board composition, diversity and independence; director compensation; IPO governance; and climate risk, and addressed its stewardship approach to governance, E&S issues and engagement.

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.