This notice is provided by Georgeson for general informational purposes only and is not intended and should not be construed as legal, regulatory, financial or tax advice. Georgeson is not licensed or authorized to practice law in any jurisdictions and hence does not provide any legal advice and it does not hold itself out as doing so. Neither Georgeson nor any of its affiliates or contributors accept any responsibility or liability for the quality, accuracy or completeness of any information contained in this notice. It is important that you seek independent professional advice relating to the subject matter of this notice before relying on it.

Introduction

The long-awaited SEC Climate Rule has been finalized as of March 6, 2024. The scaled-down version of the original proposed rule places requirements on registrants (domestic and foreign issuers) to provide climate related disclosures. The rule covers requirements for the following areas:

- GHG emissions and assurance

- Financial statement effects disclosure, presented in a note to the Financial Statements

- Additional qualitative disclosures

This report summarizes the main changes put forward in the ruling. For more detail refer to the full rule here.

Where and How to File

Any registrants (domestic and foreign issuers) that is required to file must file the climate-related disclosure in its registration statements and Exchange Act annual reports and it must electronically tag both narrative and quantitative climate-related disclosures in Inline XBRL.

A registrant must include:

- climate-related disclosures required under Regulation S-K (other than Scope 1 and 2) in a separate, appropriately captioned section of its filing (i.e., Risk Factors, MD&A, etc.)

- financial statement disclosures required under Regulation S-X for its most recently completed fiscal year, and to the extent previously disclosed, for the historical fiscal year(s) included in the filing, in a note to its audited financial statements.

Scope 1 and 2 Disclosure

All registrants (domestic and foreign issuers) that are required (based on materiality, see section A note on materiality for more details) to report on Scope 1 and 2 must report for the most recently completed fiscal year and, to the extent previously disclosed, for the historical fiscal year(s) included in the filing. Registrants must also provide an attestation report and any related disclosures. Any registrant required to file disclosures must include an express statement in its annual report indicating its intention to incorporate by reference or amend its filing for this information.

Registrants filing on domestic forms have three main options for where to file Scope 1 and 2 disclosures but must report on GHG emissions from the prior fiscal year (similar to financial statement filings) by no later than the second fiscal quarter of the following year:

- In annual report on Form 10-K

- In Form 10-Q for second fiscal quarter

- In an amendment to Form 10-K filed no later than the due date for the 10-Q for the filer’s second fiscal quarter

For a registrant that has previously disclosed emissions in an SEC filing, it must include disclosure on all historical years included in the consolidated financial statements in the filing. For a registrant that has previously not disclosed its Scope 1 and 2 emissions in any filing, they are not required to disclose prior historical data. This means that companies will not have to estimate historical data if they have never reported it in a filing, but once they start including emissions data in their filings, they will need to include that historical data if those years of data are included in the consolidated financial statement data.

Foreign private issuers not filing on domestic forms have the following options, filed no later than 225 days after the end of the fiscal year GHG emissions are being disclosed for:

- In annual report on Form 20-F

- In an amendment to Form 20-F

Assurance

- Large Accelerated Filers and Accelerated Filers must file an attestation report at the limited assurance level beginning the third fiscal year after the compliance date for disclosure of GHG emissions.

- Large Accelerated Filers must file an attestation report at the reasonable assurance level beginning the seventh fiscal year after the compliance date for the disclosure of GHG emissions.

- A registrant that is not required to disclose its GHG emissions or to include a GHG emissions attestation report pursuant to the final rules is required to disclose certain information if the registrant voluntarily discloses its GHG emissions in a Commission filing and voluntarily subjects those disclosures to third-party assurance.

- The rule states it is permissible for a firm to use its financial auditors to conduct assurance of GHG disclosures.

Overview of what is in the rule

GHG Emissions

Scope 1 and Scope 2 Emissions

Scope 1 and 2 GHG emissions to be reported in the following ways:

- Aggregated – expressed in the aggregate in terms of CO2e.

- Disaggregated – only if any constituent gas of the disclosed emissions is individually material, it must also disclose such constituent gas disaggregated from the other gases.

- Gross terms – this means excluding the impact of any purchased or generated offsets. These can be reported elsewhere but are not part of the inventory.

- Methodology – a brief description of, in sufficient detail for a reasonable investor to understand, the protocol or standard used to report the GHG emissions, including the calculation approach and/or use of market-based versus location-based methodology or both.

- Calculations – the type and source of any emission factors used, and any calculation tools used to calculate the GHG emissions.

- Assumptions / Estimates allowed – a registrant may use reasonable estimates when disclosing its GHG emissions as long as it also describes the assumptions underlying, and its reasons for using, the estimates.

A note on materiality

In the final rule, the requirements for Scope 1 and 2 emissions disclosure are subject to materiality. The rule clarifies that the SEC intends that a registrant apply traditional notions of materiality under the Federal securities laws when evaluating whether its Scopes 1 and/or 2 emissions are material. This means that materiality is not determined merely by the amount of these emissions, but by the guiding principle of whether a reasonable investor would consider the disclosure of the registrant’s Scope 1 emissions and/or its Scope 2 emissions important when making an investment or voting decision or such a reasonable investor would view omission of the disclosure as having significantly altered the total mix of information made available.

Boundaries

The final rule no longer specifies the boundary, but instead provides that the registrant can use any of the methods to determine control described under the GHG protocol. Registrants must disclose the method used to determine the organizational boundaries, and if the organizational boundaries materially differ from the scope of entities and operations included in the registrant’s consolidated financial statements, the registrant must provide a brief explanation of this difference, and an explanation of the categorization of emissions and emissions sources, in sufficient detail for a reasonable investor to understand.

Additional Qualitative Disclosures

Several additional qualitative disclosures will be required. These largely follow the guidance recommendations of the TCFD. They are summarized below, but additional detail on these can be found in the rule itself.

| SEC Disclosure Requirement | TCFD Alignment |

|

Governance |

|

Strategy |

|

Risk Management |

|

Metrics and Targets |

Safe Harbor Provision

The final rules provide a safe harbor for climate-related disclosures pertaining to transition plans, scenario analysis, the use of an internal carbon price, and targets and goals provided as part of Regulation S-K, considering these disclosures as “forward-looking statements”.

Financial Statement Effects Disclosure

- Includes contextual information and basis of calculation, and a registrant must provide contextual information, describing how each specified financial statement effect was derived, including a description of significant inputs and assumptions used, significant judgments made, and other information that is important to understand the financial statement effect and, if applicable, policy decisions made by the registrant to calculate the specified disclosure.

- Required to be presented in a note to the financial statements.

- Auditors at PCAOB-registered public accounting firms should apply the concepts of materiality in PCAOB AS 2105.

- Require disclosure for historical fiscal year(s) included in a registrant’s consolidated financial statements on a prospective basis only.

Implementation Timeline

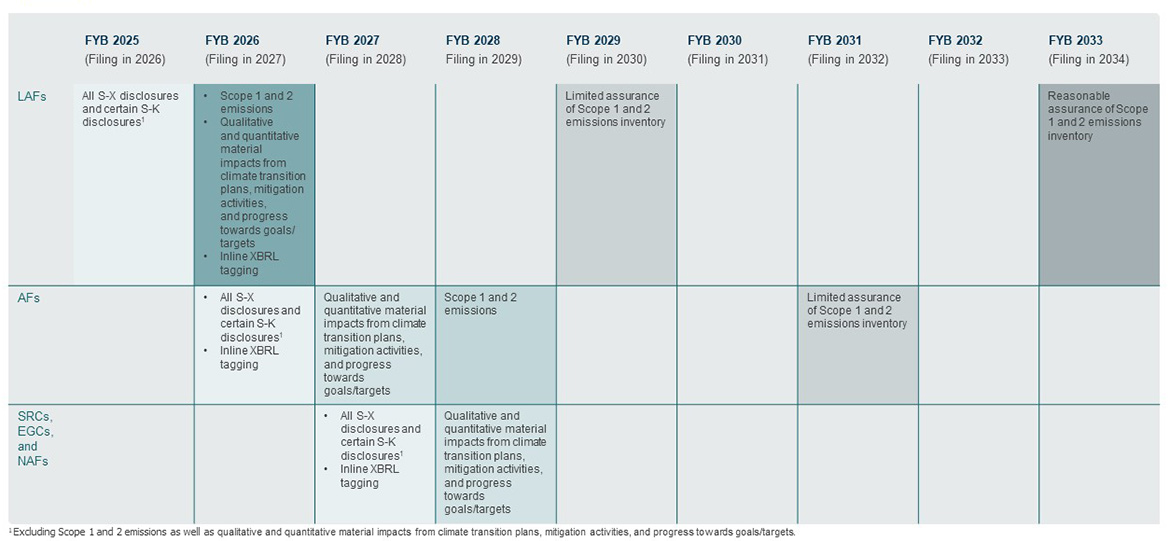

The following table summarizes the timing for implementation of the final ruling. The final ruling has adopted delayed and staggered compliance dates that vary according to the registrant type (i.e., Large Accelerated Filers (LAFs), Accelerated Filers (AFs), Smaller Reporting Companies (SRCs), and Emerging Growth Companies (EGCs)).

Compliance Timeline Based on Registrant Type

Note that dates listed refers to any fiscal year beginning in the calendar year listed. The table applies to both annual reports and registration statements; in the case of registration statements, compliance would be required beginning in any registration statement that is required to include financial information for the full fiscal year indicated in the table.

Regulation Item Descriptions

| Item Number | Description |

| 1501 | Governance |

| 1502 | Strategy, business model, and outlook |

| 1503 | Risk management |

| 1504 | Target and goals |

| 1505 | GHG emissions |

| 1506 | Attestation over GHG emissions |

Definitions of Registrant Type

| Registrant Type | Public Float | Annual Revenues |

| Smaller Reporting Company and Non-Accelerated Filer | Less than $75 million | N/A |

| $75 million to less than $700 million | Less than $100 million | |

| Smaller Reporting Company and Accelerated Filer | $75 million to less than $250 million | $100 million or more |

| Emerging Growth Company | N/A | Less than $1.235 billion |

| Accelerated Filer (not a Smaller Reporting Company) | $250 million to less than $700 million | $100 million or more |

| Large Accelerated Filer (not a Smaller Reporting Company) | $700 million or more | N/A |

Updates from the Proposed Rules

Significant updates to the rule

- Qualification based on materiality for certain disclosures.

- Scope 1 and 2 is phased in, with assurance requirements varied by filer type, and is based on materiality of emissions.

- Extended timeline for reasonable assurance requirements for large accelerated filers.

- Adjustments to the Expenditure Effects that focus on the disclosure of discrete expenditures related to severe weather events and other natural conditions including capitalized costs, expenditures expensed, charges, and losses incurred as a result of these events rather than focusing on mitigation and transition-related expenditures.

- Requires registrants to provide disclosure for historical fiscal year(s) only on a prospective basis, which will further limit the burdens on reporting companies.

- Modifications related to the specific requirements for disclosure regarding physical and transition risk to be less prescriptive.

- Climate-related risks should be separated out by short term (less than 12 months) and long term (beyond 12 months) (no longer any reference to medium term) and should be included if they have had a material impact or if they are “reasonably likely" to have an actual or potential material impact.

- A registrant will be required to provide disclosure concerning its use of carbon offsets or RECs if they constitute a material component of a registrant’s plan to achieve its climate-related targets or goals.

What is not in the rule (eliminated from the proposed rule)

- Proposed Scope 1 and 2 disclosure requirements for Small Reporting Companies or for Emerging Growth Companies.

- Proposed reasonable assurance requirements for Accelerated Filers’ Scope 1 and 2 emissions.

- Proposed Scope 3 disclosure requirements for all filers.

- Proposed requirement to describe board members’ climate expertise.

- Proposed Financial Impact Metrics to disclose the financial impacts from severe weather events and other natural conditions and transition activities on any relevant line item in the registrant’s consolidated financial statements during the fiscal years presented.

- Proposed requirement to disclose the impacts of any climate-related risks identified pursuant to proposed Item 1502(a) of Regulation S-K (final rule is subject to materiality).

- Reference to negative climate-related impacts on a registrant’s value chain from the definition of climate-related risks, rather, risks to suppliers or purchases etc. are now only required to be included "to the extent known or reasonably available".

- Proposed requirement to disclose costs and expenditures related to general transition activities in the financial statements (e.g., a portion of the proposed Expenditure Metrics), i.e., to disclose costs and expenditures incurred to “mitigate the risks from severe weather events and other natural conditions”.

- Proposed requirement to disclose any material change to the climate related disclosures provided in a registration statement or annual report in a Form 10-Q (or, in certain circumstances, Form 6-K for a registrant that is a foreign private issuer that does not report on domestic forms).

- Proposal would have required a registrant to disclose more specific detail about physical risks.

- References to climate-related opportunities and corresponding definition

- Proposed requirement to describe how any of the financial statement metrics or GHG emissions metrics relate to the registrant’s business model or business strategy.

- Proposed Greenhouse Gas Calculations provided at a disaggregated level for each GHG:

- Carbon dioxide

- Methane

- Nitrous oxide

- Nitrogen trifluoride

- Hydrofluorocarbons

- Perfluorocarbons

- Sulfur hexafluoride

- Proposed GHG calculation boundary requirement to be consistent with consolidated financial statement boundary.

- Proposed disclosure of specific quantitative emissions factors used.

- Proposed disclosure of GHG intensity metric – using total CO2e per unit of revenue and per unit produced or another intensity metric that makes sense for the specific industry

This notice is provided by Georgeson for general informational purposes only and is not intended and should not be construed as legal, regulatory, financial or tax advice. Georgeson is not licensed or authorized to practice law in any jurisdictions and hence does not provide any legal advice and it does not hold itself out as doing so. Neither Georgeson nor any of its affiliates or contributors accept any responsibility or liability for the quality, accuracy or completeness of any information contained in this notice. It is important that you seek independent professional advice relating to the subject matter of this notice before relying on it.

Georgeson is a foremost provider of strategic shareholder consulting services to corporations and shareholder groups working to influence corporate strategy. We offer advice and representation in annual meetings, mergers and acquisitions, proxy contests and other extraordinary transactions. Our core proxy expertise is enhanced with and complemented by our corporate governance consulting and asset reunification services.

For more information, visit www.georgeson.com or call 212 440 9800.