Earlier this year, T. Rowe Price (TRP) published updates to its proxy voting policies effective for 2019 annual meetings.1 The material changes are summarized below. The policies largely remain unchanged from TRP's 2018 voting policy updates, at which time the investor made significant updates.

In addition to the summary of 2019 policy updates, we have also summarized TRP's 2017 engagement policy.

Material 2019 Policy Updates

Board Diversity – 2019 Update

This year, TRP updated its policy on board diversity, demonstrating the investor's evolving focus on this important issue. As we noted in previously-published Georgeson reports on BlackRock, Vanguard, State Street 2019 investor proxy voting policy updates, board diversity is increasingly becoming part of institutional investor voting policy guidelines and is likely to influence progress in board composition.

In its 2018 policy update, TRP stated that a board would be considered meaningfully diverse if it presented some diversity in gender, ethnic, or nationality. At that time, TRP had not adopted a formal voting policy on board diversity. New this year, TRP has sharpened its focus on this matter. Its updated policy states that it will generally oppose the re-election of Governance Committee members if the board is not diverse. However, TRP did not provide specific diversity targets for companies to meet. TRP voting history shows an overall declining level of support for director elections. It will be interesting to see how TRP's new board diversity policy will affect its director voting decisions in the 2019 proxy season.

The table below reflects TRP's support for the nominees in director elections for Russell 3000 companies over the last four years.2

Social and Environmental Shareholder Proposals

TRP's existing policy, under which it analyzes social and environmental shareholder proposals on a case-by-case basis, remains largely unchanged. Its policy provides that TRP will consider supporting "well targeted" shareholder proposals addressing concerns relevant to a company's business. New this year, TRP added specific language explaining that it may vote against a shareholder proposal seeking additional environmental and social disclosure if it concludes that a company's existing disclosure on that environmental or social topic is adequate.

In its "2018 Aggregate Proxy Voting Summary" report, TRP disclosed that it supported 9%3 of shareholder proposals concerning environmental issues in 2018.4 Additionally, it supported about 13% of socially-oriented proposals, "in particular those advocating for non-discriminatory employment policies or strengthening the diversity of the company's board."

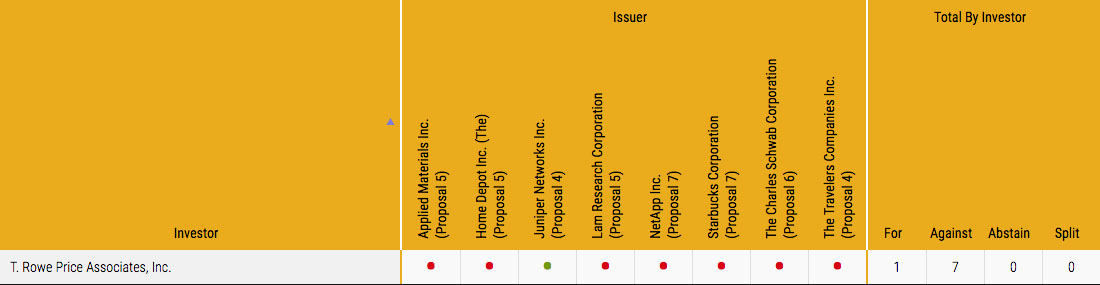

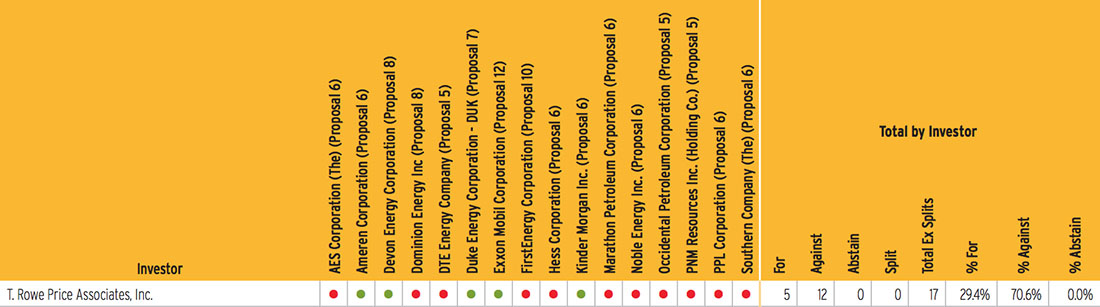

The tables below illustrate TRP's voting history on two recent shareholder proposals voted on at companies in the S&P 1500. The data shows TRP voting against most of these Social and Environmental proposals.

2018 Shareholder Proposal Voting History: Select Employment Diversity Shareholder Proposals2

2017 Shareholder Proposal Proxy Voting History: Select Climate Change Proposals2

Considerations for Engagement with T. Rowe Price

In light of the increasing demand for meaningful engagement between portfolio companies and institutional investors, an increasing number of such investors have published reports on its engagement policies and practices. We have summarized T. Rowe Price's engagement policy, published in 2017. The engagement policy highlights how and why TRP chooses to engage with companies.5 T. Rowe's published engagement policy outlines its definition of and objectives for engagement with companies. Generally, TRP has three possible objectives when initiating engagement:

- to obtain information from an issuer to assist TRP in making a voting decision;

- to share its perspective with an issuer on a particular matter relating to corporate governance or sustainability; or

- to accommodate an issuer's request to share information or perspective with TRP.

TRP's engagement policy provides clear guidance on how it prioritizes engagements, how to contact the investor, who should participate in the calls, and what materials are helpful to have on calls, if any.

TRP encourages issuers to review the TRP Proxy Voting and Responsible Investment guidelines in advance of any engagement calls.

As a founding member in the Investor Stewardship Group (ISG) launched in 2017, TRP is in a unique position to align its engagement principles with the ISG framework. As detailed in this Georgeson report on ISG Principles, the ISG Framework includes the following six principles:

- Principle 1: Boards are accountable to shareholders.

- Principle 2: Shareholders should be entitled to voting rights in proportion to their economic interest.

- Principle 3: Boards should be responsive to shareholders and be proactive in order to understand their perspectives.

- Principle 4: Boards should have a strong, independent leadership structure.

- Principle 5: Boards should adopt structures and practices that enhance their effectiveness.

- Principle 6: Boards should develop management incentive structures that are aligned with the long-term strategy of the company.

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.

1 https://www.troweprice.com/content/dam/trowecorp/Pdfs/C35H15KRK_Final.pdf

2 Data provided by Georgeson's 2018 Annual Corporate Governance Review, in partnership with Proxy Insight Ltd.

4 July 1, 2017 – June 30, 2018

5 Engagement policy: https://www.troweprice.com/content/dam/trowecorp/Pdfs/T.%20Rowe%20Price%20Engagement%20Policy.pdf